Asked by Jordan Storberg on Jun 09, 2024

Verified

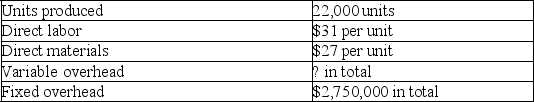

A company reports the following information regarding its production cost:

Required: Perform the following independent calculations.

Required: Perform the following independent calculations.

a.Compute total variable overhead cost if the production cost per unit under variable costing is $240.

b.Compute total variable overhead cost if the production cost per unit under absorption costing is $240.

Variable Overhead Cost

Costs that vary with the level of production output, such as supplies and utilities for manufacture.

Variable Costing

An accounting method that includes only variable production costs (direct materials, direct labor, and variable manufacturing overhead) in the cost of goods sold, excluding fixed overhead costs.

Absorption Costing

A cost accounting method that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed overhead - as part of the cost of a finished product.

- Ascertain the cost per unit for production and the concluding inventory valuations under variable and absorption costing techniques.

Verified Answer

VOH/22,000 = $182

Total variable overhead = ($182 × 22,000)= $4,004,000

b.$31 DL + $27 DM + (VOH/22,000)+ ($2,750,000/22,000)FOH = $240

VOH/22,000 = $57

Total variable overhead = ($57 × 22,000)$1,254,000 total variable overhead

Learning Objectives

- Ascertain the cost per unit for production and the concluding inventory valuations under variable and absorption costing techniques.

Related questions

Lukin Corporation Reports the Following First Year Production Cost Information ...

Home Base,Inc.reports the Following Production Cost Information ...

Castaway Company Reports the Following First Year Production Cost Information ...

Home Base,Inc.reports the Following Production Cost Information ...

A Company Reports the Following Information Regarding Its Production Cost ...