Asked by Julie David on May 08, 2024

Verified

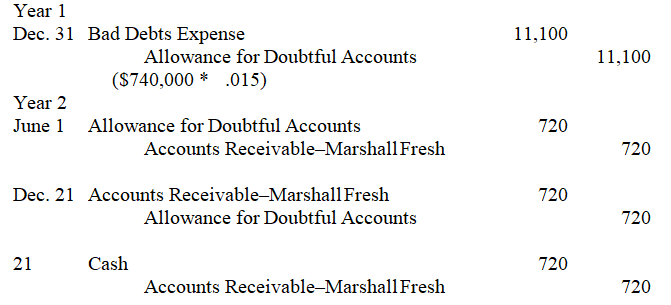

A company that uses the percent of sales to account for its bad debts had credit sales of $740,000 in Year 1,including a $720 sale to Marshall Fresh.On December 31,Year 1,the company estimated its bad debts at 1.5% of its credit sales.On June 1,Year 2,the company wrote off,as uncollectible,the $720 account of Marshall Fresh.On December 21,Year 2,Marshall Fresh unexpectedly paid his account in full.Prepare the necessary journal entries:

(a)On December 31,Year 1,to reflect the estimate of bad debts expense.

(b)On June 1,Year 2,to write off the bad debt.

(c)On December 21,Year 2,to record the unexpected collection.

Percent of Sales

Percent of sales is a financial analysis tool that helps in estimating how certain accounts, like revenue and expenses, will vary in proportion to changes in sales.

Bad Debts

Debts that are not recoverable and are written off as a loss by the business because they cannot be collected.

Journal Entries

Journal entries are the recordings of financial transactions in the books of accounts, serving as the primary input in the accounting system.

- Comprehend and distinguish between different approaches to accounting for bad debts.

- Elucidate and compute the expense related to bad debt by employing the allowance technique.

Verified Answer

Learning Objectives

- Comprehend and distinguish between different approaches to accounting for bad debts.

- Elucidate and compute the expense related to bad debt by employing the allowance technique.

Related questions

The Branson Company Uses the Percent of Sales Method of ...

The Lily Company Uses the Percent of Receivables Method of ...

The Allowance Method of Accounting for Bad Debts Requires an ...

Describe the Differences in How the Direct Write-Off Method and ...

On February 1,a Customer's Account Balance of $2,300 Was Deemed ...