Asked by Gabrielle Gwizdala on May 18, 2024

Verified

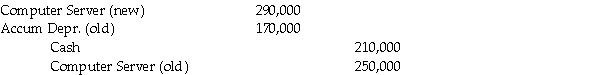

A computer server system, which had cost $250,000 and had accumulated depreciation of $170,000, was traded for a new system with a fair market value of $245,000. The old system and cash of $210,000 were given for the new system. Prepare the journal entry for the exchange of these similar assets assuming the income tax method is used to record the exchange.

Accumulated Depreciation

The total depreciation for an asset that has been recorded up to a specific point in time, reflecting its decline in value.

Fair Market Value

The price at which an asset would exchange hands between a willing buyer and seller, both having reasonable knowledge of all necessary facts.

Income Tax Method

When plant assets are exchanged, tax law says the gain or loss must be absorbed into the cost of the new asset.

- Understand the principles of accounting for asset exchanges and their impact on the cost basis of the acquired asset.

Verified Answer

Learning Objectives

- Understand the principles of accounting for asset exchanges and their impact on the cost basis of the acquired asset.

Related questions

Ken Alberts Owned Equipment with an Original Cost of $45,000 ...

The Cutcut Mower Service Owned a Truck with an Original ...

Journalize the Following Transactions for Pets R Us ...

Which of the Following Would Result If the Business Purchased ...

Bob Purchased a New Computer for the Company for Cash ...