Asked by Adeel Mukhtar on May 19, 2024

Verified

A coupon bond that pays interest annually has a par value of $1,000, matures in 5 years, and has a yield to maturity of 12%. If the coupon rate is 9%, the intrinsic value of the bond today will be ________.

A) $856.04

B) $891.86

C) $926.47

D) $1,000

Coupon Bond

A bond that pays the holder a fixed interest rate (coupon payment) over the bond's lifetime, in addition to returning the principal at maturity.

Yield To Maturity

The total return anticipated on a bond if the bond is held until its maturity date, considering all payments and the face value.

Intrinsic Value

The true, inherent, and underlying value of an asset, independent of its market price.

- Calculate the yield to maturity and understand its essentiality.

Verified Answer

LS

LivingLifeWith SuperiorMay 24, 2024

Final Answer :

B

Explanation :

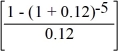

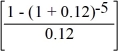

PV0 = $90  +

+  ; PV0 = $891.86

; PV0 = $891.86

Calculator entries are N = 5, I/Y = 12, PMT = 90, FV = 1,000, CPT PV → −891.86

+

+  ; PV0 = $891.86

; PV0 = $891.86Calculator entries are N = 5, I/Y = 12, PMT = 90, FV = 1,000, CPT PV → −891.86

Learning Objectives

- Calculate the yield to maturity and understand its essentiality.