Asked by Viraj Mistry on Jun 26, 2024

Verified

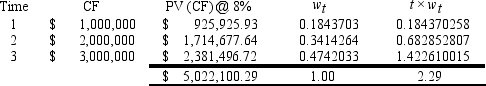

A pension fund must pay out $1 million next year, $2 million the following year, and then $3 million the year after that. If the discount rate is 8%, what is the duration of this set of payments?

A) 2 years

B) 2.15 years

C) 2.29 years

D) 2.53 years

Discount Rate

The interest rate charged to commercial banks and other depository institutions for loans received from the Federal Reserve's discount window.

Duration

Duration measures a bond's sensitivity to changes in interest rates, representing the weighted average time to receive the bond's cash flows.

Payments

Transactions or transfers of money from one person or entity to another.

- Ascertain the functions of duration in immunization strategy creation and interest rate risk mitigation.

Verified Answer

TI

Learning Objectives

- Ascertain the functions of duration in immunization strategy creation and interest rate risk mitigation.