Asked by Lizbeth Longoria on Jul 21, 2024

Verified

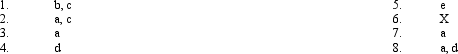

Accounting information might be separately reported in any of the following components of the income statement or statement of retained earnings and their supporting schedules and footnotes:

a. income from continuing operations or supporting schedules

b. extraordinary gains or losses

c. footnote disclosure

d. statement of retrined earnings

e. results from discontinued operations

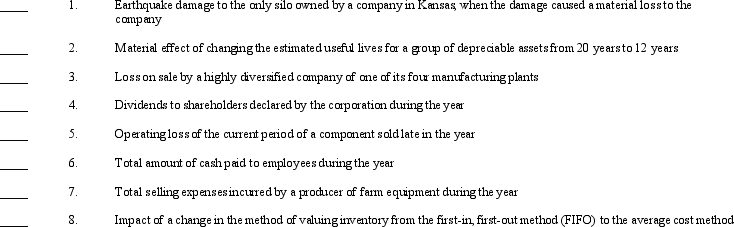

Several items of accounting information are listed below.

Required:

Required:

By placing the letters (a-e)in the space provided above, identify where the information would be most appropriately reported.If the information would not appear in any of the above components, place an (X)in the space.Items may be reported in more than one location.

Income Statement

A financial statement that shows a company's revenues, expenses, and profits over a specific period.

Extraordinary Gains

Profits from events or transactions that are both unusual in nature and infrequent in occurrence, though this distinction has been eliminated in current accounting practices.

- Identify the differences between extraordinary items and customary operational items on financial income statements.

- Distinguish among the diverse methods for presenting financial health and status.

Verified Answer

SB

Learning Objectives

- Identify the differences between extraordinary items and customary operational items on financial income statements.

- Distinguish among the diverse methods for presenting financial health and status.

Related questions

For an Event or Transaction to Be Classified as an ...

Below Is a List of Financial Statement Components with a ...

On the Income Statement,income from Discontinued Operations Is Shown ...

If the Adjustment to Recognize Expired Insurance at the End ...

How Should a Material, Infrequent Event Not Meeting the Criteria ...