Asked by Dangerously Loved on May 29, 2024

Verified

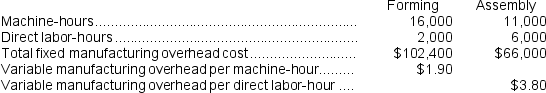

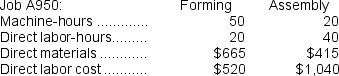

Amason Corporation has two production departments, Forming and Assembly.The company uses a job-order costing system and computes a predetermined overhead rate in each production department.The Forming Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours.At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job A950.The following data were recorded for this job:

During the current month the company started and finished Job A950.The following data were recorded for this job:  Required:

Required:

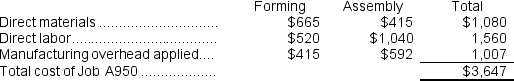

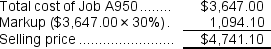

Calculate the selling price for Job A950 if the company marks up its unit product costs by 30% to determine selling prices.

Predetermined Overhead Rate

An estimated overhead rate used to apply manufacturing overhead to products, calculated before the accounting period begins.

Direct Labor-Hours

The total hours worked by employees directly involved in the manufacturing process, used as a basis for allocating overhead costs.

Machine-Hours

A measure of the amount of time machines are operated during the production process, used for allocating costs or measuring productivity.

- Calculate the retail price of assignments using markup percentages.

Verified Answer

Forming Department overhead cost = Fixed manufacturing overhead cost + (Variable overhead cost per machine-hour × Total machine-hours in the department)

= $102,400 + ($1.90 per machine-hour × 16,000 machine-hours)

= $102,400 +$30,400 = $132,800

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the = $132,800 ÷ 16,000 machine-hours = $8.30 per machine-hour

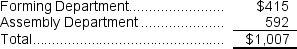

Overhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = $8.30 per machine-hour × 50 machine-hours = $415

Assembly Department:

Assembly Department overhead cost = Fixed manufacturing overhead cost + (Variable overhead cost per direct labor-hour × Total direct labor-hours in the department)

= $66,000 + ($3.80 per direct labor-hour × 6,000 direct labor-hours)

= $66,000 + $22,800 = $88,800

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the = $88,800 ÷6,000 direct labor-hours = $14.80 per direct labor-hour

Overhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = $14.80 per direct labor-hour × 40 direct labor-hours = $592

Overhead applied to Job A950

Learning Objectives

- Calculate the retail price of assignments using markup percentages.

Related questions

Pasko Corporation Uses a Job-Order Costing System with a Single ...

Mcewan Corporation Uses a Job-Order Costing System with a Single ...

Stockmaster Corporation Has Two Manufacturing Departments--Forming and Assembly ...

The Markup Percent Is Based on Selling Price ...

Clark Thomas Wants to Purchase a Side Table for His ...