Asked by Annaliet Martinez on Apr 27, 2024

Verified

An accounting student has just been introduced to present value analysis and comes to you with the following question, "How is present value used in the financial statements?"

Required:

Give the student examples of financial statement accounts that are stated at present value and explain the advantages of using present value for certain financial statement items.

Present Value Analysis

The process of determining the present worth of a future stream of cash flows by applying a discount rate to account for the time value of money.

Financial Statements

Formal records of the financial activities and position of a business, individual, or other entity.

Financial Statement Accounts

Accounts that appear on the financial statements, including assets, liabilities, equity, revenues, and expenses.

- Comprehend the fundamental principle of present value and the method for calculating it for both lump sums and annuities.

- Assess the dependability and pertinence of employing present value in accounting assessments.

Verified Answer

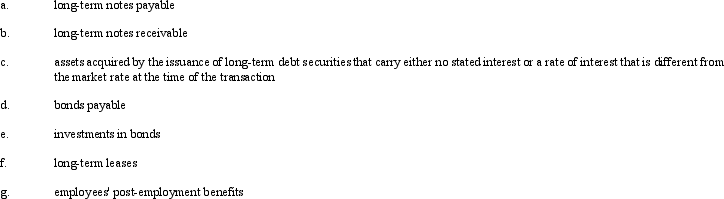

Present value is more relevant to the users of financial statements.Many assets and liabilities will be overstated if present value is not used.For example, if a company purchased land by signing a 5-year, noninterest-bearing note, the land and the note should be carried on the balance sheet at the present value of future cash flows.If not, both the asset and the liability would be overstated.Present value takes into consideration the time value of money, which enables the user of the financial statements to obtain a more accurate picture of the financial condition of the company.

Present value is more relevant to the users of financial statements.Many assets and liabilities will be overstated if present value is not used.For example, if a company purchased land by signing a 5-year, noninterest-bearing note, the land and the note should be carried on the balance sheet at the present value of future cash flows.If not, both the asset and the liability would be overstated.Present value takes into consideration the time value of money, which enables the user of the financial statements to obtain a more accurate picture of the financial condition of the company.

Learning Objectives

- Comprehend the fundamental principle of present value and the method for calculating it for both lump sums and annuities.

- Assess the dependability and pertinence of employing present value in accounting assessments.

Related questions

Although Most Accountants Believe That the Use of Present Value ...

On January 1, 2010, Steelton Company Completed Arrangements to Purchase ...

You Are Going to Withdraw $1,000 at the End of ...

Calculate the Present Value of a Growing Annuity Given the ...

Your Uncle Left You an Inheritance in the Form of ...