Asked by saurav basnet on May 02, 2024

Verified

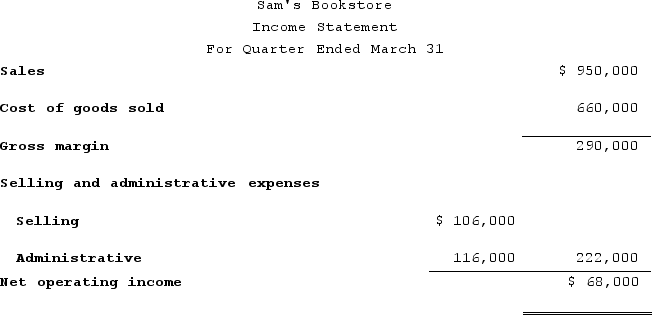

An income statement for Sam's Bookstore for the first quarter of the year is presented below:  On average, a book sells for $50. Variable selling expenses are $4 per book with the remaining selling expenses being fixed. The variable administrative expenses are 5% of sales with the remainder being fixed. The contribution margin for Sam's Bookstore for the first quarter is:

On average, a book sells for $50. Variable selling expenses are $4 per book with the remaining selling expenses being fixed. The variable administrative expenses are 5% of sales with the remainder being fixed. The contribution margin for Sam's Bookstore for the first quarter is:

A) $214,000

B) $826,500

C) $166,500

D) $783,500

Contribution Margin

The amount remaining from sales revenue after variable expenses have been deducted, indicating how much revenue is available to cover fixed expenses and to contribute to profit.

Variable Administrative Expenses

Costs that vary in proportion to changes in an organization's activity level, such as sales commissions.

- Incorporate the contribution margin idea into business strategy and decision-making.

Verified Answer

AT

Aaron TeitelbaumMay 02, 2024

Final Answer :

C

Explanation :

To determine the contribution margin, we need to first calculate the total sales revenue and total variable expenses.

Total sales revenue = ($50/book) x 16,500 books = $825,000

Total variable expenses = ($4/book) x 16,500 books + (0.05 x $825,000) = $231,750

Therefore, the contribution margin is:

Contribution margin = Total sales revenue - Total variable expenses

= $825,000 - $231,750

= $593,250

Therefore, the best choice is C, with a contribution margin of $166,500 for the first quarter.

Total sales revenue = ($50/book) x 16,500 books = $825,000

Total variable expenses = ($4/book) x 16,500 books + (0.05 x $825,000) = $231,750

Therefore, the contribution margin is:

Contribution margin = Total sales revenue - Total variable expenses

= $825,000 - $231,750

= $593,250

Therefore, the best choice is C, with a contribution margin of $166,500 for the first quarter.

Learning Objectives

- Incorporate the contribution margin idea into business strategy and decision-making.

Related questions

Which of the Following Approaches to Preparing an Income Statement ...

A Division Sold 200000 Calculators During 2017 How Much Is ...

Assume That Widgeon Produced Enough of the Product with the ...

Contribution Margin Is Also Known as Gross Margin

The Bottom Line of a Contribution Margin Report Is Net ...