Asked by Tiana Hailey on May 19, 2024

Verified

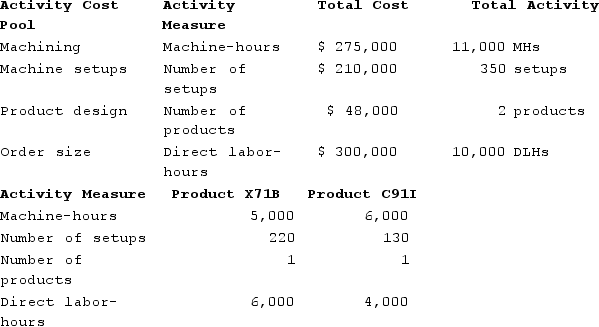

Arrojo Corporation manufactures two products: Product X71B and Product C91I. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products X71B and C91I.  Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product X71B?

Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product X71B?

A) $416,500

B) $499,800

C) $333,200

D) $372,000

Plantwide Overhead Rate

A single overhead absorption rate used throughout a factory or plant for allocating overhead costs to products.

Activity-based Costing

An accounting method that identifies the activities that incur costs and then assigns indirect costs to products based on their use of those activities.

- Appreciate the consequence of utilizing Activity-Based Costing on the cost structuring of products compared with old-school costing techniques.

Verified Answer

JE

Jahongir ErgashevMay 25, 2024

Final Answer :

B

Explanation :

Using the plantwide overhead rate, the total overhead cost is divided by the total direct labor-hours:

($1,249,400 ÷ 25,000 DLHs = $49.98/DLH)

Product X71B:

Direct labor-hours = 8,336 DLHs

Manufacturing overhead allocated = ($49.98/DLH × 8,336 DLHs = $416,500)

Product C91I:

Direct labor-hours = 16,664 DLHs

Manufacturing overhead allocated = ($49.98/DLH × 16,664 DLHs = $833,300)

Total overhead allocated = ($416,500 + $833,300 = $1,249,800)

($1,249,400 ÷ 25,000 DLHs = $49.98/DLH)

Product X71B:

Direct labor-hours = 8,336 DLHs

Manufacturing overhead allocated = ($49.98/DLH × 8,336 DLHs = $416,500)

Product C91I:

Direct labor-hours = 16,664 DLHs

Manufacturing overhead allocated = ($49.98/DLH × 16,664 DLHs = $833,300)

Total overhead allocated = ($416,500 + $833,300 = $1,249,800)

Learning Objectives

- Appreciate the consequence of utilizing Activity-Based Costing on the cost structuring of products compared with old-school costing techniques.