Asked by James Lombino on Jul 09, 2024

Verified

Assume that Tolar decides to upgrade the calculators.At what selling price per unit would the company be as well off as if it just sold the calculators in their present condition?

A) $8 per calculator

B) $30 per calculator

C) $53 per calculator

D) $67 per calculator

Selling Price

The amount a seller charges for a product or service.

Upgrading Calculators

The process of replacing or enhancing calculators to include more advanced features or capabilities, often to improve efficiency or meet new requirements.

Present Condition

The current state or situation of an object, individual, or scenario, often assessed to make decisions or predictions.

- Assess the fiscal repercussions associated with the debut of a novel product or the agreement to a special order.

Verified Answer

Price per calculator × 400 calculators > $11,200 + $10,000

Price per calculator × 400 calculators > $21,200

Price per calculator > $21,200 ÷ 400 calculators = $53 per calculator

Reference: CH11-Ref4

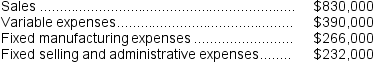

The management of Bonga Corporation is considering dropping product D74F.Data from the company's accounting system for this product for last year appear below:

All fixed expenses of the company are fully allocated to products in the company's accounting system.Further investigation has revealed that $111,000 of the fixed manufacturing expenses and $103,000 of the fixed selling and administrative expenses are avoidable if product D74F is discontinued.

All fixed expenses of the company are fully allocated to products in the company's accounting system.Further investigation has revealed that $111,000 of the fixed manufacturing expenses and $103,000 of the fixed selling and administrative expenses are avoidable if product D74F is discontinued.

Learning Objectives

- Assess the fiscal repercussions associated with the debut of a novel product or the agreement to a special order.

Related questions

If the New Product Is Added Next Year, the Financial ...

What Is the Financial Advantage (Disadvantage)to the Company from Upgrading ...

What Is the Financial Advantage (Disadvantage)of Alternative Y Over Alternative ...

Gallerani Corporation Has Received a Request for a Special Order ...

At What Selling Price Would the New Product Be Just ...