Asked by Kiersten Deavy on Apr 25, 2024

Verified

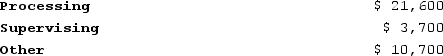

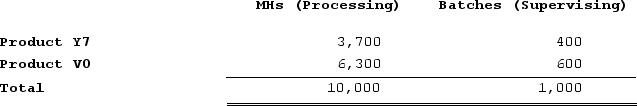

Bachrodt Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below

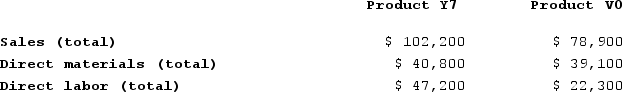

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

What is the overhead cost assigned to Product Y7 under activity-based costing?

What is the overhead cost assigned to Product Y7 under activity-based costing?

A) $7,992

B) $1,480

C) $18,000

D) $9,472

Overhead Cost

Expenses not directly tied to production activities, such as rent, utilities, and administrative costs.

Product Y7

A hypothetical or specific product, referred to by the identifier Y7, which may represent a model, version, or variant in a lineup.

Activity-Based Costing

A pricing approach that allocates overheads and indirect expenses to particular tasks, resulting in more precise cost estimation for products.

- Analyze how overhead costs are attributed to products and customers within the framework of Activity-Based Costing.

Verified Answer

Activity cost rate for Processing = Processing costs / total MHs = $104,000 / 3,000 MHs = $34.67 per MH

Activity cost rate for Supervising = Supervising costs / total batches = $56,000 / 350 batches = $160 per batch

Using these activity cost rates, we can allocate the Processing and Supervising costs to Product Y7:

Processing costs = MHs for Y7 * Processing activity cost rate = 250 MHs * $34.67 per MH = $8,667

Supervising costs = batches for Y7 * Supervising activity cost rate = 15 batches * $160 per batch = $2,400

Total overhead cost assigned to Y7 = Processing costs + Supervising costs = $8,667 + $2,400 = $11,067

However, there is still $1,595 of costs in the Other activity cost pool that have not been allocated to products. We need to allocate these costs based on the proportion of Processing and Supervising costs each product incurred.

Total Processing and Supervising costs for all products = $104,000 + $56,000 = $160,000

Proportion of Processing costs for Y7 = $8,667 / $104,000 = 0.0835

Proportion of Supervising costs for Y7 = $2,400 / $56,000 = 0.0429

Allocating Other costs to Y7:

Other costs allocated to Y7 = Proportion of Processing costs * Other costs + Proportion of Supervising costs * Other costs

= 0.0835 * $19,000 + 0.0429 * $19,000 = $2,228

Total cost assigned to Y7 = Direct costs + Overhead costs = $25,000 + $11,067 + $2,228 = $38,295

Therefore, the overhead cost assigned to Product Y7 under activity-based costing is $9,472 (Processing + Supervising overhead) + $2,228 (Other costs allocated) = $11,700. Answer D is the closest option to this value.

Learning Objectives

- Analyze how overhead costs are attributed to products and customers within the framework of Activity-Based Costing.

Related questions

Delauder Enterprises Makes a Variety of Products That It Sells ...

ScholfieldEnterprises Makes a Variety of Products That It Sells to ...

Offerman Corporation Is Conducting a Time-Driven Activity-Based Costing Study in ...

Flemming Corporation Uses Activity-Based Costing to Compute Product Margins ...

Delauder Enterprises Makes a Variety of Products That It Sells ...