Asked by Ishmail Mgwena on May 08, 2024

Verified

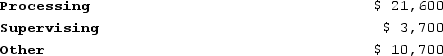

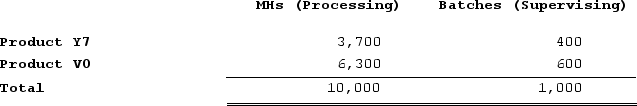

Bachrodt Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below

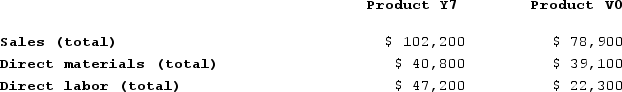

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

What is the product margin for Product Y7 under activity-based costing?

What is the product margin for Product Y7 under activity-based costing?

A) −$3,800

B) $4,728

C) $14,200

D) $6,208

Product Margins

The difference between the selling price of a product and the cost to produce it, reflecting the profitability of each product sold.

Machine-Hours

A measure used in accounting to allocate manufacturing overhead costs, representing the total hours that machines are operated in the production of goods.

Number of Batches

The total count of groups or sets of items processed or produced together in a manufacturing or production process.

- Calculate product margins under ABC.

Verified Answer

Processing Overhead Rate = Total Processing Cost / Total Machine Hours = $88,000 / 5,500 MHs = $16 per MH

Supervising Overhead Rate = Total Supervising Cost / Total Batches = $22,500 / 250 Batches = $90 per Batch

Next, we need to assign the overhead costs to each product based on the activity data:

Product Y7 Processing overhead = 1,100 MHs x $16 per MH = $17,600

Product Y7 Supervising overhead = 25 Batches x $90 per Batch = $2,250

Now we can calculate the total cost and product margin for Product Y7:

Product Y7 Total Cost = Direct Materials + Direct Labor + Processing Overhead + Supervising Overhead = $16,000 + $12,000 + $17,600 + $2,250 = $47,850

Product Y7 Sales Revenue = $52,000

Product Y7 Product Margin = Sales Revenue - Total Cost = $52,000 - $47,850 = $4,728

Therefore, the answer is B ($4,728).

Learning Objectives

- Calculate product margins under ABC.

Related questions

Flemming Corporation Uses Activity-Based Costing to Compute Product Margins ...

Musich Corporation Has an Activity-Based Costing System with Three Activity ...

Neas Corporation Has an Activity-Based Costing System with Three Activity ...

Greife Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Machining ...

Zwahlen Corporation Has an Activity-Based Costing System with Three Activity ...