Asked by Jaysha sereal on May 09, 2024

Verified

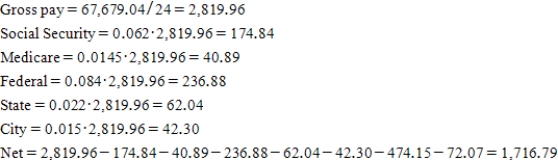

Benjamin started a new job and wants to verify that his net pay has been computed correctly.His salary is $67,679.04 per year.Ben is paid semiannually and has the following deductions: Social Security tax 6.2%,Medicare tax 1.45%,federal withholding 8.4%,state withholding 2.2%,city withholding 1.5%,retirement contributions $474.15,and medical and dental insurance $72.07.What should his net pay be for this pay period?

Net Pay

The amount of money a worker takes home after all deductions, such as taxes and retirement contributions, have been subtracted from the gross salary.

Social Security Tax

The amount of Social Security a worker pays depends on the Social Security percentage and the maximum taxable income for that year; the amount is split between the employee and the employer.

Medicare Tax

A federal tax deducted from employees' paychecks to fund the Medicare program, which provides healthcare to seniors.

- Calculate net salary by deducting various withholdings and deductions from gross income.

Verified Answer

KR

Learning Objectives

- Calculate net salary by deducting various withholdings and deductions from gross income.