Asked by Jocelyn Espericueta on Apr 25, 2024

Verified

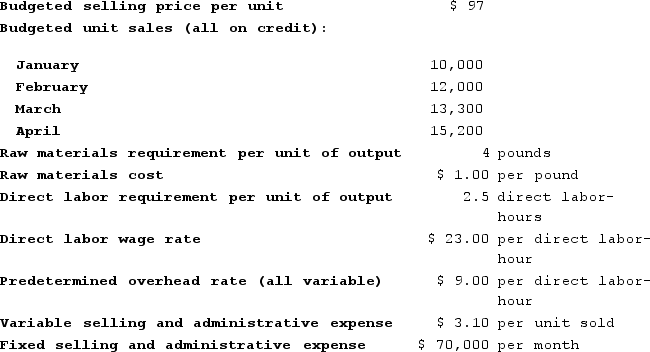

Bonkowski Corporation makes one product and has provided the following information to help prepare the master budget for the next four months of operations:  Credit sales are collected:30% in the month of the sale70% in the following monthRaw materials purchases are paid:30% in the month of purchase70% in the following monthThe ending finished goods inventory should equal 30% of the following month's sales. The ending raw materials inventory should equal 10% of the following month's raw materials production needs.The expected cash collections for February is closest to:

Credit sales are collected:30% in the month of the sale70% in the following monthRaw materials purchases are paid:30% in the month of purchase70% in the following monthThe ending finished goods inventory should equal 30% of the following month's sales. The ending raw materials inventory should equal 10% of the following month's raw materials production needs.The expected cash collections for February is closest to:

A) $970,000

B) $1,028,200

C) $349,200

D) $679,000

Cash Collections

The process of gathering and managing payments received from customers or clients.

Credit Sales

Sales transactions where the payment is deferred, and goods or services are provided on credit.

Raw Materials Purchases

The total cost of raw materials bought for use in the production of goods or products during a specific accounting period.

- Recognize the critical role of effective cash flow control in business operations.

Verified Answer

DR

Daniela Rodriguez6 days ago

Final Answer :

B

Explanation :

To calculate the expected cash collections for February, we need to calculate the amount of credit sales made in December (two months before February) and January (one month before February) and the amount collected in February.

Credit sales made in December = $1,500,000

Credit sales made in January = $1,800,000

Amount collected in February = ($1,500,000 x 0.3) + ($1,800,000 x 0.7) = $970,000

Therefore, the expected cash collections for February are $1,028,200.

Credit sales made in December = $1,500,000

Credit sales made in January = $1,800,000

Amount collected in February = ($1,500,000 x 0.3) + ($1,800,000 x 0.7) = $970,000

Therefore, the expected cash collections for February are $1,028,200.

Learning Objectives

- Recognize the critical role of effective cash flow control in business operations.