Asked by Megan Green on Jun 25, 2024

Verified

Border Company purchased a truck that cost $17,000.The company signed a $17,000 note payable that specified four equal annual payments (at each year-end),each of which includes a payment on the principal and interest on the unpaid balance at 10% per annum.

A.Calculate the amount of each equal payment (round your answer to the nearest whole dollar amount).

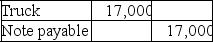

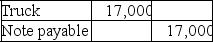

B.Prepare the journal entry to record the purchase of the truck.

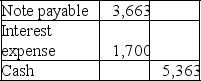

C.Prepare the journal entry to record the first annual payment on the note (assume no interest has been accrued during the year).

D.Will the interest paid with the first annual payment be more than,or less than,the interest paid with the second annual payment? Explain your answer.

Note Payable

A written promise to pay a specified sum of money, often bearing interest, at a future date.

Interest Payment

The amount paid at intervals by a borrower to a lender as compensation for the use of borrowed money.

Principal Payment

A payment towards the original amount of a loan, not including interest.

- Understand the calculation and recording of equal annual payments on notes payable that include principal and interest.

Verified Answer

KM

Keith MacNeilJul 01, 2024

Final Answer :

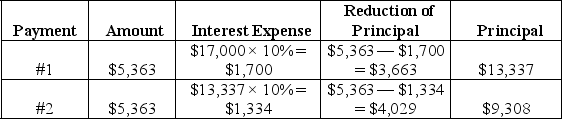

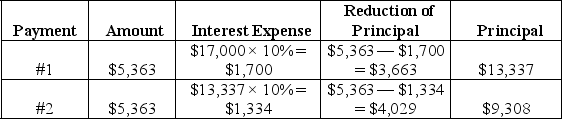

A.$17,000 ÷ 3.1699 (present value of an ordinary annuity,10%,4 periods)= $5,363

B.

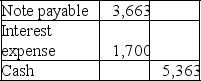

C.

C.

D.The interest paid on the first installment will be more than the interest on the second payment because the balance of the note will decrease after the first payment.Interest is calculated on the balance of the note so interest amount will decrease also.

D.The interest paid on the first installment will be more than the interest on the second payment because the balance of the note will decrease after the first payment.Interest is calculated on the balance of the note so interest amount will decrease also.

B.

C.

C. D.The interest paid on the first installment will be more than the interest on the second payment because the balance of the note will decrease after the first payment.Interest is calculated on the balance of the note so interest amount will decrease also.

D.The interest paid on the first installment will be more than the interest on the second payment because the balance of the note will decrease after the first payment.Interest is calculated on the balance of the note so interest amount will decrease also.

Learning Objectives

- Understand the calculation and recording of equal annual payments on notes payable that include principal and interest.