Asked by Jattiya Arrianna on May 21, 2024

Verified

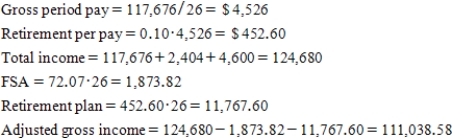

Brittany's W-2 reported total Medicare withholding based on wages of as $117,676.She contributed $72.07 biweekly to her FSA and 10% of each paycheck to her retirement plan.She received a 1099 from her bank for interest and dividends of $2,404 and a 1099 form in the amount of $4,600 from an employer for whom she did some consulting work.What is Brittany's adjusted gross income?

Adjusted Gross Income

Total income minus specific deductions, used to determine taxable income on an individual's tax return.

Medicare Withholding

The portion of an individual's income that is deducted for Medicare, which is a form of health insurance typically for individuals aged 65 and older.

FSA

A Flexible Spending Account, which is a special account used for setting aside pre-tax dollars for eligible healthcare and dependent care expenses.

- Calculate Adjusted Gross Income (AGI) from various types of income and deductions.

Verified Answer

SC

Learning Objectives

- Calculate Adjusted Gross Income (AGI) from various types of income and deductions.