Asked by Jincy Robin on May 20, 2024

Verified

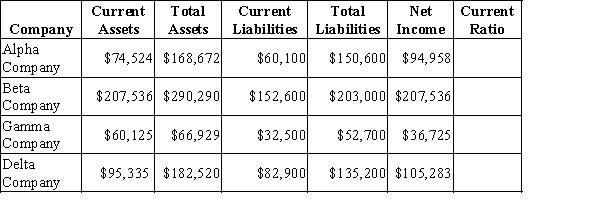

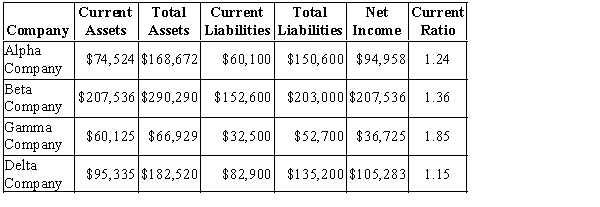

Calculate the current ratio for each business below. Which business has the best short-term solvency position given your calculations?

Current Ratio

A financial metric comparing a company's current assets to its current liabilities to assess liquidity.

Short-Term Solvency

A company's ability to meet its short-term obligations, often assessed using liquidity ratios.

- Determine a company’s current ratio and understand its implications for short-term solvency.

Verified Answer

KK

KHOO KHAI WEI CELINE studentMay 21, 2024

Final Answer :

Gamma Company has the best short-term solvency position, because its current ratio is the highest. Gamma Company's current ratio is calculated as its current assets divided by its current liabilities, or $60,125/$32,500 = 1.85. Thus its current assets are 1.85 times its current liabilities, meaning that, of all the companies shown, Gamma Company is best able to pay its current liabilities as they come due.

Learning Objectives

- Determine a company’s current ratio and understand its implications for short-term solvency.