Asked by Becca Moore on May 21, 2024

Verified

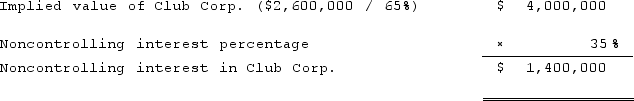

Caldwell Inc. acquired 65% of Club Corp. for $2,600,000. There was no active market for the shares of Club Corp. Club owned a building and equipment with ten-year useful lives. The combined book value of these assets was $830,000, and the fair value was $950,000. For Club's other assets and liabilities, book value was equal to fair value. The total acquisition-date fair value of Club's net assets was $3,500,000.Determine the amount of the noncontrolling interest as of the date of the acquisition.

Noncontrolling Interest

Refers to the portion of equity in a subsidiary not attributable directly or indirectly to the parent company.

Acquisition-Date Fair Value

The fair value of an asset or liability at the date it is acquired in a business combination.

Combined Book Value

The total value of a company's assets as recorded in its financial books, excluding intangible items and liabilities.

- Understand the determination of noncontrolling interest and its value at the date of acquisition.

Verified Answer

ON

Learning Objectives

- Understand the determination of noncontrolling interest and its value at the date of acquisition.