Asked by dhanashree sangaokar on May 27, 2024

Verified

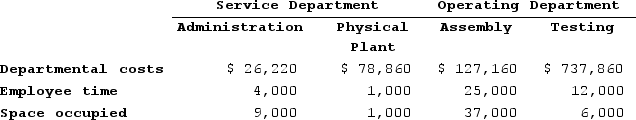

Cervetti, Incorporated, allocates service department costs to operating departments using the step-down method. The company has two service departments, Administration and Physical Plant, and two operating departments, Assembly and Testing. Data concerning those departments follow:  Administration Department costs are allocated first on the basis of employee time and Physical Plant Department costs are allocated second on the basis of space occupied. The total Testing Department cost after allocations is closest to:

Administration Department costs are allocated first on the basis of employee time and Physical Plant Department costs are allocated second on the basis of space occupied. The total Testing Department cost after allocations is closest to:

A) $754,279

B) $757,240

C) $748,960

D) $757,368

Step-down Method

An allocation method used in cost accounting to distribute overhead costs to various cost centers and products in stages based on their usage of services.

Physical Plant Department

The division within an organization responsible for managing and maintaining the physical facilities, including buildings and grounds.

Space Occupied

The amount of physical area taken up by an object, person, or activity, typically measured in square feet or meters.

- Understand the cumulative budgetary effect on departments after implementing service department cost allocations with the step-down method.

- Adopt methodologies for cost allocation utilizing varied indicators including area in square feet, worker count, personnel-related costs, and duration of labor.

- Inspect the impact of cost assignments on the spending patterns of operational departments.

Verified Answer

Total employee time for all departments = 10,000 hours

Employee time for Administration Department = 2,500 hours

Employee time for Physical Plant Department = 1,500 hours

Allocation rate for Administration Department = Administration Department costs / Administration Department employee time

= $400,000 / 2,500 hours

= $160 per hour

Administration Department cost allocated to Physical Plant Department

= Administration Department employee time * Allocation rate

= 1,500 hours * $160 per hour

= $240,000

Now, we allocate the Physical Plant Department costs on the basis of space occupied.

Total square footage for all departments = 200,000 sq. ft.

Square footage for Physical Plant Department = 50,000 sq. ft.

Square footage for Assembly Department = 80,000 sq. ft.

Square footage for Testing Department = 70,000 sq. ft.

Allocation rate for Physical Plant Department = Physical Plant Department costs / Physical Plant Department square footage

= $360,000 / 50,000 sq. ft.

= $7.20 per sq. ft.

Physical Plant Department cost allocated to Assembly Department

= Physical Plant Department square footage of Assembly Department * Allocation rate

= 80,000 sq. ft. * $7.20 per sq. ft.

= $576,000

Physical Plant Department cost allocated to Testing Department

= (Physical Plant Department square footage of Assembly Department + Physical Plant Department square footage of Testing Department) * Allocation rate

= (80,000 sq. ft. + 70,000 sq. ft.) * $7.20 per sq. ft.

= $1,440,000

Total cost allocated to the Testing Department = Testing Department direct cost + Physical Plant Department cost allocated to Testing Department

= $1,200,000 + $1,440,000

= $2,640,000

Therefore, the closest answer is $757,240 (Option B).

Learning Objectives

- Understand the cumulative budgetary effect on departments after implementing service department cost allocations with the step-down method.

- Adopt methodologies for cost allocation utilizing varied indicators including area in square feet, worker count, personnel-related costs, and duration of labor.

- Inspect the impact of cost assignments on the spending patterns of operational departments.

Related questions

San Juan Minerals (SJM) Has Two Service Departments and Two ...

Strzelecki Corporation Uses the Step-Down Method to Allocate Service Department ...

Anchor Corporation Has Two Service Departments, Personnel and Engineering, and ...

Muckenfuss Clinic Uses the Step-Down Method to Allocate Service Department ...

The Step-Down Method of Service Department Cost Allocation Ignores Interdepartmental ...