Asked by Benny Csillag on Apr 24, 2024

Verified

Chiodini Inc.has a $900,000 investment opportunity that involves sales of $2,430,000, fixed expenses of $1,044,900, and a contribution margin ratio of 50% of sales.The ROI for this year's investment opportunity considered alone is closest to:

A) 16.3%

B) 18.9%

C) 7.0%

D) 135.0%

Fixed Expenses

These are costs that do not change with the level of production or sales, such as rent, salaries, and insurance.

Return On Investment

A measure used to evaluate the efficiency of an investment or compare the efficiencies of several different investments.

- Appraise the influence of capital allocation decisions on the financial outcomes of a corporation.

Verified Answer

AT

Alyssa TollefsenMay 02, 2024

Final Answer :

B

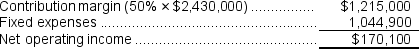

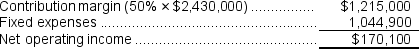

Explanation :  ROI = Net operating income ÷ Average operating assets = $170,100 ÷ $900,000 = 18.9%

ROI = Net operating income ÷ Average operating assets = $170,100 ÷ $900,000 = 18.9%

ROI = Net operating income ÷ Average operating assets = $170,100 ÷ $900,000 = 18.9%

ROI = Net operating income ÷ Average operating assets = $170,100 ÷ $900,000 = 18.9%

Learning Objectives

- Appraise the influence of capital allocation decisions on the financial outcomes of a corporation.

Related questions

Which of the Following Measures of Performance Encourages Continued Expansion ...

All Other Things Equal, Which of the Following Would Increase ...

Some Investment Opportunities That Should Be Accepted from the Viewpoint ...

Youns Increported the Following Results from Last Year's Operations: ...

Cirone Inc ...