Asked by Joseph Hasson on May 22, 2024

Verified

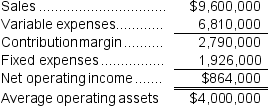

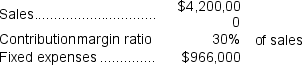

Cirone Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:  If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

A) 3.1%

B) 8.4%

C) 6.3%

D) 12.1%

Combined Margin

A metric that combines multiple types of profit margins (such as gross, operating, or net margin) to assess overall performance.

- Assess the consequences of investment choices on a firm’s financial metrics.

Verified Answer

AC

arlene calcenaMay 27, 2024

Final Answer :

B

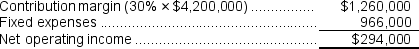

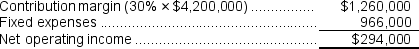

Explanation :  Net operating income = $864,000 + $294,000 = $1,158,000

Net operating income = $864,000 + $294,000 = $1,158,000

Sales = $9,600,000 + $4,200,000 = $13,800,000

Margin = Net operating income ÷ Sales = $1,158,000 ÷ $13,800,000 = 8.4%

Net operating income = $864,000 + $294,000 = $1,158,000

Net operating income = $864,000 + $294,000 = $1,158,000Sales = $9,600,000 + $4,200,000 = $13,800,000

Margin = Net operating income ÷ Sales = $1,158,000 ÷ $13,800,000 = 8.4%

Learning Objectives

- Assess the consequences of investment choices on a firm’s financial metrics.

Related questions

Which of the Following Measures of Performance Encourages Continued Expansion ...

Some Investment Opportunities That Should Be Accepted from the Viewpoint ...

All Other Things Equal, Which of the Following Would Increase ...

Youns Increported the Following Results from Last Year's Operations: ...

Chiodini Inc ...