Asked by Aliyah Grant on Jun 26, 2024

Verified

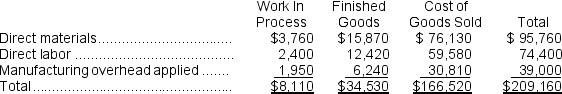

Coatney Inc.has provided the following data for the month of October.There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month.  Manufacturing overhead for the month was overapplied by $7,000. The Corporation allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the manufacturing overhead applied during the month in those accounts.

Manufacturing overhead for the month was overapplied by $7,000. The Corporation allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the manufacturing overhead applied during the month in those accounts.

The finished goods inventory at the end of October after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

A) $35,686

B) $33,374

C) $33,410

D) $35,650

Overapplied Manufacturing Overhead

A situation where the allocated manufacturing overhead costs assigned to products are more than the actual overhead costs incurred.

Allocation

The process of distributing resources or costs across various departments, projects, or activities within a company.

Finished Goods Inventory

Inventory items that have completed the manufacturing process and are ready for sale.

- Acquire knowledge on the distribution technique for underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold accounts.

Verified Answer

Total manufacturing costs = Direct materials + Direct labor + Applied manufacturing overhead

Total manufacturing costs = $149,000 + $94,000 + $58,000

Total manufacturing costs = $301,000

Cost of goods manufactured = Total manufacturing costs + Beginning work in process - Ending work in process

Since there were no beginning work in process and all units produced were sold or put into finished goods, Cost of goods manufactured = Total manufacturing costs

Cost of goods manufactured = $301,000

To allocate the overapplied manufacturing overhead, we need to determine the percentage of manufacturing overhead applied during the month in the accounts of work in process, finished goods, and cost of goods sold.

Manufacturing overhead applied = Total manufacturing overhead - Overapplied manufacturing overhead

Manufacturing overhead applied = $58,000 - $7,000

Manufacturing overhead applied = $51,000

Percentage of manufacturing overhead applied to work in process = $0 / $301,000 = 0%

Percentage of manufacturing overhead applied to finished goods = $91,000 / $301,000 = 30.23%

Percentage of manufacturing overhead applied to cost of goods sold = $210,000 / $301,000 = 69.77%

We can now allocate the overapplied manufacturing overhead to finished goods.

Overapplied manufacturing overhead allocated to finished goods = Percentage of manufacturing overhead applied to finished goods x Amount of overapplied manufacturing overhead

Overapplied manufacturing overhead allocated to finished goods = 30.23% x $7,000

Overapplied manufacturing overhead allocated to finished goods = $2,121

Adjusted cost of goods manufactured = Cost of goods manufactured + Overapplied manufacturing overhead allocated to finished goods

Adjusted cost of goods manufactured = $301,000 + $2,121

Adjusted cost of goods manufactured = $303,121

Finished goods inventory at the end of October = Adjusted cost of goods manufactured - Cost of goods sold

Finished goods inventory at the end of October = $303,121 - $269,711

Finished goods inventory at the end of October = $33,410

Therefore, the finished goods inventory at the end of October after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to $33,410, making option C the correct answer.

Learning Objectives

- Acquire knowledge on the distribution technique for underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold accounts.

Related questions

Fils IncHas Provided the Following Data for the Month of ...

If the Actual Manufacturing Overhead Cost for a Period Exceeds ...

If Manufacturing Overhead Is Underapplied, Then ...

Overapplied Manufacturing Overhead Would Result If ...

Beshaw Incorporated Has Provided the Following Data for the Month ...