Asked by LYNETTA White on Jul 19, 2024

Verified

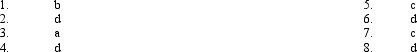

Costs associated with various intangibles of a company may either be expensed when incurred or capitalized and amortized.Such costs might be recorded in any of the following ways:

a. charged to the patent account and amortized

b. charged to the franchise ac count and amortized

c. charged to other appropriate asset ac counts and amortized or depreciateo

d. charged to expense when incurred

Required:

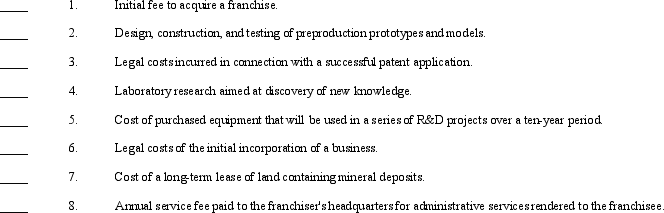

Indicate how each of the following costs should be recorded by placing the appropriate letter (a-d)in the space provided.

Intangibles

Assets that cannot be touched or physically measured, such as patents, copyrights, and trademarks.

Amortized

The process of gradually writing off the initial cost of an asset over a period, thereby reducing its book value on a company's balance sheet.

Expensed

Expensed items refer to costs that are charged against revenue in the current accounting period instead of being capitalized or recorded as an asset.

- Apply accounting rules to determine the capitalization of costs related to software development and patents.

Verified Answer

HJ

Learning Objectives

- Apply accounting rules to determine the capitalization of costs related to software development and patents.