Asked by Lindsay Stavnes on Jun 14, 2024

Verified

Craney Corporation makes one product and it provided the following information to help prepare the master budget for the next four months of operations:> The budgeted selling price per unit is $87. Budgeted unit sales for January, February, March, and April are 7,100, 8,300, 13,700, and 13,600 units, respectively. All sales are on credit.> Regarding credit sales, 20% are collected in the month of the sale and 80% in the following month.> The ending finished goods inventory equals 40% of the following month's sales.> The ending raw materials inventory equals 40% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $1.00 per pound.> Regarding raw materials purchases, 30% are paid for in the month of purchase and 70% in the following month.> The direct labor wage rate is $19.00 per hour. Each unit of finished goods requires 2.7 direct labor-hours.Required:a. What are the budgeted sales for February?b. What are the expected cash collections for February?c. According to the production budget, how many units should be produced in February?d. If 68,300 pounds of raw materials are needed for production in March, how many pounds of raw materials should be purchased in February?e. What is the estimated cost of raw materials purchases for February?f. If the cost of raw material purchases in January is $43,660, then in February what are the estimated cash disbursements for raw materials purchases?g. What is the total estimated direct labor cost for February assuming the direct labor workforce is adjusted to match the hours required to produce the forecasted number of units produced?

Master Budget

A comprehensive financial planning document that consolidates all of an organization's budgets for various departments or activities.

Budgeted Selling Price

The projected price at which a product is expected to be sold, factored into business planning and budgeting processes.

Raw Materials

Basic materials and components used at the beginning of the production process to manufacture goods.

- Design complete master budget frameworks, integrating forecasts for sales, production activities, and cash flow.

Verified Answer

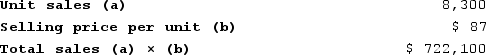

b. The expected cash collections for February are computed as follows:

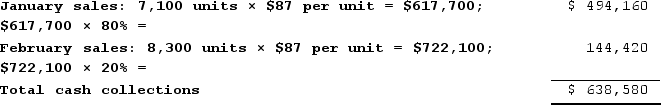

b. The expected cash collections for February are computed as follows: c. The budgeted required production for February is computed as follows:

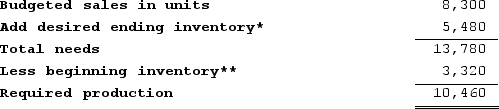

c. The budgeted required production for February is computed as follows: *March sales of 13,700 units × 40% = 5,480 units** February sales of 8,300 units × 40% = 3,320 units d. The budgeted raw material purchases for February are computed as follows:

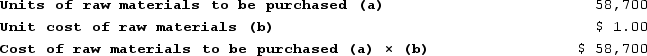

*March sales of 13,700 units × 40% = 5,480 units** February sales of 8,300 units × 40% = 3,320 units d. The budgeted raw material purchases for February are computed as follows: * 68,300 pounds × 40% = 27,320 pounds.** 52,300 pounds × 40% = 20,920 pounds.e. The budgeted cost of raw material purchases for February is computed as follows:

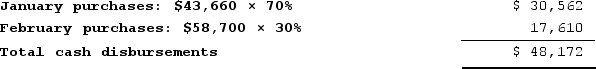

* 68,300 pounds × 40% = 27,320 pounds.** 52,300 pounds × 40% = 20,920 pounds.e. The budgeted cost of raw material purchases for February is computed as follows: f. The estimated cash disbursements for materials purchases in February is computed as follows:

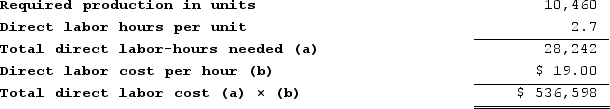

f. The estimated cash disbursements for materials purchases in February is computed as follows: g. The estimated direct labor cost for February is computed as follows:

g. The estimated direct labor cost for February is computed as follows:

Learning Objectives

- Design complete master budget frameworks, integrating forecasts for sales, production activities, and cash flow.

Related questions

Capes Corporation Is a Wholesaler of Industrial Goods ...

A Sales Budget Is Given Below for One of the ...

Botz Corporation Makes One Product and It Provided the Following ...

Weller Industrial Gas Corporation Supplies Acetylene and Other Compressed Gases ...

Mumbower Corporation Makes One Product and Has Provided the Following ...