Asked by Tyler Cluff on Jun 15, 2024

Verified

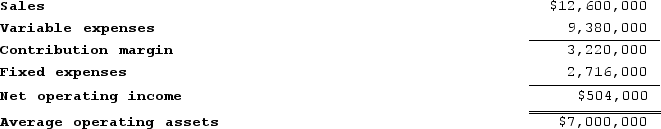

Craycraft Incorporated reported the following results from last year's operations:

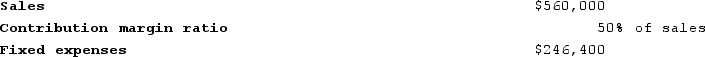

At the beginning of this year, the company has a $800,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $800,000 investment opportunity with the following characteristics:

Required:

Required:

1. What was last year's margin? (Round to the nearest 0.1%.)

2. What was last year's turnover? (Round to the nearest 0.01.)

3. What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall margin this year? (Round to the nearest 0.1%.)

5. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall turnover this year? (Round to the nearest 0.01.)

6. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall return on investment will this year? (Round to the nearest 0.1%.)

Margin

The difference between the selling price of a product and the cost of producing it, often expressed as a percentage of the selling price.

Turnover

The total sales generated by a company in a specified period, or the rate at which inventory or assets of a business "turn over" or are replaced.

Return on Investment

A metric utilized to assess the effectiveness or gains of an investment or to contrast the effectiveness of various investments.

- Measure the economic benefits of fresh investment options and their impact on the organization's comprehensive performance.

- Examine financial records to determine margin, turnover, and ROI for performance appraisal.

Verified Answer

2. Last year's Turnover = Sales ÷ Average operating assets = $12,600,000 ÷ $7,000,000 = 1.80

3. Last year's Return on investment = Net operating income ÷ Average operating assets = $504,000 ÷ $7,000,000 = 7.2%

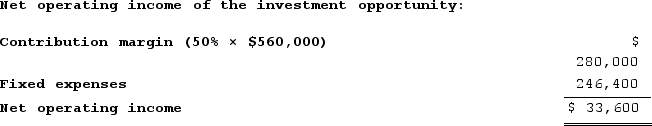

4. If the company pursues the investment opportunity and otherwise performs the same as last year, the margin will be:

5. If the company pursues the investment opportunity and otherwise performs the same as last year, the turnover will be:

5. If the company pursues the investment opportunity and otherwise performs the same as last year, the turnover will be:Sales = $12,600,000 + $560,000 = $13,160,000

Average operating assets = $7,000,000 + $800,000 = $7,800,000

Turnover = Sales ÷ Average operating assets = $13,160,000 ÷ $7,800,000 = 1.69

6. If the company pursues the investment opportunity and otherwise performs the same as last year, the return on investment will be:

Return on investment = Net operating income ÷ Average operating assets = $537,600 ÷ $7,800,000 = 6.9%

Learning Objectives

- Measure the economic benefits of fresh investment options and their impact on the organization's comprehensive performance.

- Examine financial records to determine margin, turnover, and ROI for performance appraisal.

Related questions

Worley Incorporated Reported the Following Results from Last Year's Operations ...

Familia Incorporated Reported the Following Results from Last Year's Operations ...

Willing Incorporated Reported the Following Results from Last Year's Operations ...

The Clipper Corporation Had Net Operating Income of $380,000 and ...

Ranallo Incorporated Reported the Following Results from Last Year's Operations ...