Asked by Danielle Thompson on Jun 16, 2024

Verified

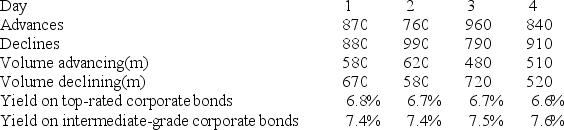

Cumulative breadth for the 4 days is ________, which is ________.

A) -140; bullish

B) -140; bearish

C) -300; bullish

D) -300; bearish

Cumulative Breadth

A technical analysis tool that measures the advancing and declining stocks on an exchange to assess market direction.

Bullish

A descriptive term for investor sentiment that believes a particular security or market is heading for an increase in prices.

Bearish

A term used in investing to describe the belief that a market, asset, or economy is on a downward trajectory.

- Expound on the principle behind market indicators, including the confidence index, TRIN, and breadth.

Verified Answer

= (870 - 880) + (760 - 990) + (960 - 790) + (840 - 910) = -140

Negative cumulative breadth is bearish.

Learning Objectives

- Expound on the principle behind market indicators, including the confidence index, TRIN, and breadth.

Related questions

You Find That the Confidence Index Is Down, the Market ...

The Most Common Measure of ________ Is the Spread Between ...

Marketing Segmentation Separates Consumers of a Product into Different Groups ...

Use the Formula , Where = to Calculate ...

In Order to Build Long-Term Relationships with Investors,it Is Important ...