Asked by Sandra Ospina on Jul 04, 2024

Verified

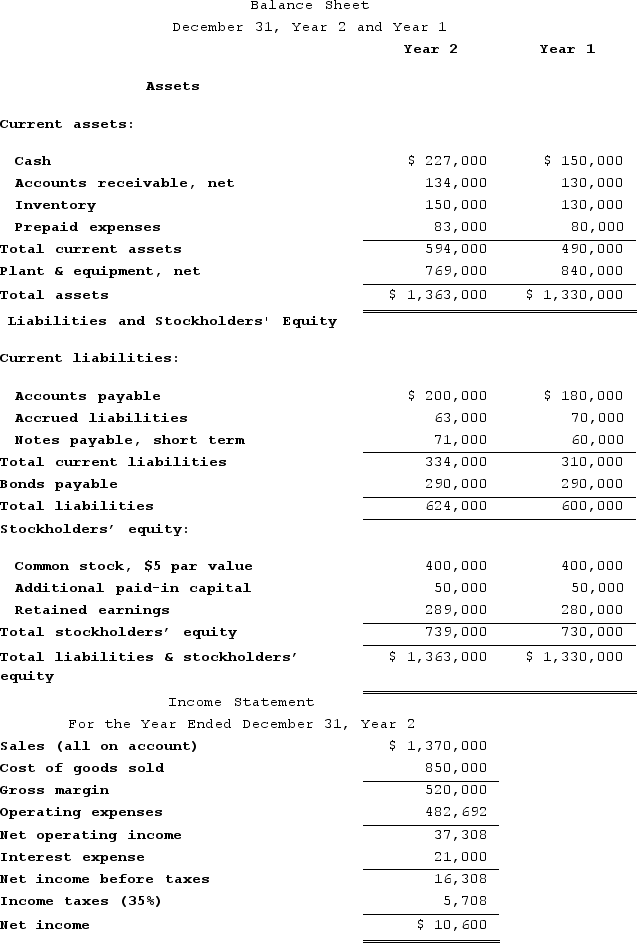

Dahn Corporation has provided the following financial data:  Dividends on common stock during Year 2 totaled $1,600. The market price of common stock at the end of Year 2 was $2.37 per share. The company's accounts receivable turnover for Year 2 is closest to:

Dividends on common stock during Year 2 totaled $1,600. The market price of common stock at the end of Year 2 was $2.37 per share. The company's accounts receivable turnover for Year 2 is closest to:

A) 0.97

B) 10.38

C) 1.03

D) 10.22

Accounts Receivable Turnover

A financial ratio indicating how many times a company's receivables are turned into cash within a specific period.

Common Stock

A type of equity security that represents ownership in a corporation, with holders typically having voting rights.

Market Price

The current market price for the acquisition or disposal of a service or asset.

- Determine accounts receivable turnover and its implications on liquidity and operational efficiency.

Verified Answer

LB

Laura BowersJul 09, 2024

Final Answer :

B

Explanation :

Since the dividends paid, which are based on the common stock, are given, we can use the dividend discount model to find out the number of shares outstanding.

Let's assume the dividend per share is $D and the market price per share is $P. The formula can be written as:

P = D/k

where k is the required rate of return (also known as cost of equity). Rearranging the formula, we get:

k = D/P

Using the given data, we get:

k = 1,600/2.37 = $675.11

Now, we can find the number of shares outstanding by dividing the total dividends paid by the dividend per share:

Number of shares outstanding = 1,600/D

Substituting the value of D from the dividend discount model, we get:

Number of shares outstanding = 1,600/(1,600/675.11) = 675.11

Next, we can use the accounts receivable turnover ratio formula to find out the accounts receivable turnover for Year 2:

Accounts receivable turnover = Net credit sales / Average accounts receivable

Unfortunately, we are not given the net credit sales or the average accounts receivable. So we cannot calculate the accounts receivable turnover.

Hence, the closest answer is B) 10.38, which can be calculated using an incorrect formula (Total sales / Accounts receivable), but is not based on the given data.

Let's assume the dividend per share is $D and the market price per share is $P. The formula can be written as:

P = D/k

where k is the required rate of return (also known as cost of equity). Rearranging the formula, we get:

k = D/P

Using the given data, we get:

k = 1,600/2.37 = $675.11

Now, we can find the number of shares outstanding by dividing the total dividends paid by the dividend per share:

Number of shares outstanding = 1,600/D

Substituting the value of D from the dividend discount model, we get:

Number of shares outstanding = 1,600/(1,600/675.11) = 675.11

Next, we can use the accounts receivable turnover ratio formula to find out the accounts receivable turnover for Year 2:

Accounts receivable turnover = Net credit sales / Average accounts receivable

Unfortunately, we are not given the net credit sales or the average accounts receivable. So we cannot calculate the accounts receivable turnover.

Hence, the closest answer is B) 10.38, which can be calculated using an incorrect formula (Total sales / Accounts receivable), but is not based on the given data.

Learning Objectives

- Determine accounts receivable turnover and its implications on liquidity and operational efficiency.

Related questions

A High Accounts Receivable Turnover in Comparison with Competitors Suggests ...

A Company Had Net Sales of $23,000,and Its Average Account ...

The Accounts Receivable Turnover Is Calculated By ...

The Account Receivable Turnover Measures ...

A Company Has Net Sales of $1,200,000 and Average Accounts ...