Asked by Eunice Monpremier on Jul 04, 2024

Verified

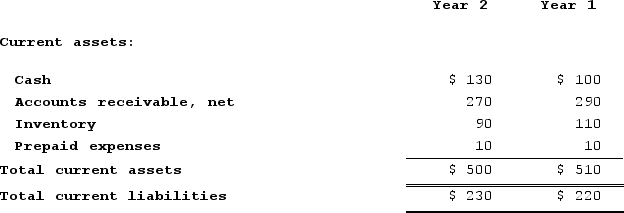

Data from Dunshee Corporation's most recent balance sheet appear below:  Sales on account in Year 2 amounted to $1,170 and the cost of goods sold was $730.The acid-test (quick) ratio at the end of Year 2 is closest to:

Sales on account in Year 2 amounted to $1,170 and the cost of goods sold was $730.The acid-test (quick) ratio at the end of Year 2 is closest to:

A) 2.17

B) 1.78

C) 1.74

D) 1.06

Acid-Test Ratio

is a financial metric that assesses a company's ability to pay off its current liabilities with its most liquid assets, excluding inventory.

Balance Sheet

An accounting document summarizing assets, liabilities, and owners' equity of a business on a specific date.

Sales On Account

Transactions where goods are sold and payment is deferred, allowing the buyer to pay at a later date, typically generating accounts receivable for the seller.

- Apprehend the methodology and relevance of the acid-test (quick) ratio.

Verified Answer

( Current assets - Inventory - Prepaid expenses ) / Current liabilities

Based on the information provided, the current assets and current liabilities from the balance sheet are:

Current Assets:

Cash and marketable securities = $450

Accounts receivable = $280

Inventory = $290

Prepaid expenses = $50

Total current assets = $1,070

Current Liabilities:

Accounts payable = $200

Accrued expenses = $300

Total current liabilities = $500

Using the formula for the acid-test (quick) ratio, we can calculate it as:

( 1,070 - 290 - 50 ) / 500 = 1.74

Therefore, the acid-test (quick) ratio at the end of Year 2 is closest to 1.74, which is answer choice C.

Learning Objectives

- Apprehend the methodology and relevance of the acid-test (quick) ratio.

Related questions

Excerpts from Sydner Corporation's Most Recent Balance Sheet Appear Below ...

Forman and Brasso Furniture Company Had Cash of $182,400, Accounts ...

Refer to Multiple Enterprises, Inc

Thompson Laser Company Had Cash of $160,000; Accounts Receivable of ...

Refer to the Following Selected Financial Information from Fennie's, LLC ...