Asked by ronak hindocha on Apr 24, 2024

Verified

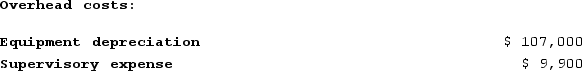

Doede Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment depreciation and supervisory expense--to three activity cost pools--Machining, Order Filling, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools:

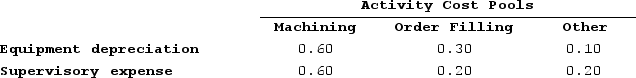

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.Activity:

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.Activity:

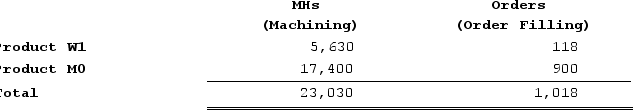

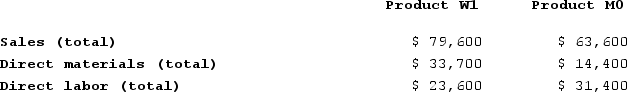

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.Sales and Direct Cost Data:

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.Sales and Direct Cost Data:

What is the overhead cost assigned to Product W1 under activity-based costing? (Round your intermediate calculations to 2 decimal places and your final answer to nearest whole dollar amount.)

What is the overhead cost assigned to Product W1 under activity-based costing? (Round your intermediate calculations to 2 decimal places and your final answer to nearest whole dollar amount.)

A) $17,172

B) $70,140

C) $21,122

D) $3,951

Overhead Cost

Indirect expenses related to the general operation of a company, including administrative and facility costs not directly tied to production.

Activity-Based Costing

A costing method that assigns costs to products based on the activities required to produce them, improving accuracy by identifying cost drivers.

Machine-Hours

A measure of production time, expressed in hours, that machinery is operating.

- Ascertain the overhead cost allocated to products utilizing Activity-Based Costing.

Verified Answer

Step 1: Allocate the overhead accounts to the activity cost pools based on resource consumption percentages:

- Machining: (0.35 * $410,000) + (0.25 * $230,000) = $176,500

- Order Filling: (0.30 * $410,000) + (0.60 * $230,000) = $287,000

- Other: (0.05 * $410,000) + (0.15 * $230,000) = $47,500

Step 2: Assign Machining costs to products using machine-hours:

- Machining cost per MH = $176,500 / 35,000 MHs = $5.04 per MH

- Overhead cost assigned to Product W1 for Machining = 4,000 MHs * $5.04 per MH = $20,160

Step 3: Assign Order Filling costs to products using the number of orders:

- Order Filling cost per order = $287,000 / 7,600 orders = $37.76 per order

- Overhead cost assigned to Product W1 for Order Filling = 200 orders * $37.76 per order = $7,552

Step 4: Calculate the total overhead cost assigned to Product W1:

- Total overhead cost assigned to Product W1 = $20,160 + $7,552 = $27,712

Therefore, the overhead cost assigned to Product W1 under activity-based costing is $21,122 (rounded to the nearest whole dollar amount). Therefore, the best choice is C.

Learning Objectives

- Ascertain the overhead cost allocated to products utilizing Activity-Based Costing.

Related questions

Bartow Corporation Uses an Activity Based Costing System to Assign ...

Meester Corporation Has an Activity-Based Costing System with Three Activity ...

Doede Corporation Uses Activity-Based Costing to Compute Product Margins ...

Addleman Corporation Has an Activity-Based Costing System with Three Activity ...

Deemer Corporation Has an Activity-Based Costing System with Three Activity ...