Asked by Frisca Kim Lun on Jul 18, 2024

Verified

During 2017 Red Dragon Corporation had the following transactions and events:

1. Issued par value preferred stock for cash at par value.

2. Issued par value common stock for cash at an amount greater than par value.

3. Completed a 2 for 1 stock split in which the $10 par value common stock was changed to $5 par value stock.

4. Declared a small stock dividend when the market value was higher than the par value.

5. Declared a cash dividend.

6. Made a prior period adjustment for understatement of net income.

7. Issued par value common stock for cash at par value.

8. Paid the cash dividend.

9. Issued the shares of common stock required by the stock dividend declaration in 4. above.

Instructions

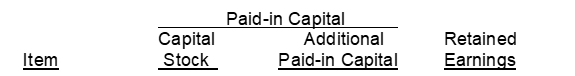

Indicate the effect(s) of each of the foregoing items on the subdivisions of stockholders' equity. Present your answers in tabular form with the following columns. Use (I) for increase (D) for decrease and (NE) for no effect.

Stock Split

A corporate action that increases the number of shares in a company, reducing the price per share without changing the market capitalization.

Preferred Stock

A type of stock that gives holders preferential treatment over common stockholders regarding dividends and claims on assets in case of liquidation.

Common Stock

Shares of ownership in a corporation, giving holders voting rights and a share in the company's profits via dividends.

- Comprehend the effects of corporate transactions and events on stockholders' equity, including stock issuance, dividends, and stock splits.

Verified Answer

Capital Additional Retained Item Stock Paid-in Capital Earnings 1.INENE2.IINE3.NENENE4.IID5.NENED6.NENE17.1NENE8.NENENE9.NENENE\begin{array}{lccc}&\text { Capital} & \text { Additional } & \text { Retained }\\\text { Item }& \text { Stock } & \text { Paid-in Capital }& \text { Earnings }\\\hline1 . & I & N E & N E \\2 . & I & I & N E \\3 . & N E & N E & N E \\4 . & I & I & D \\5 . & N E & N E & D \\6 . & N E & N E & 1 \\7 . & 1 & N E & N E \\8 . & N E & N E & N E \\9 . & N E & N E & N E\end{array} Item 1.2.3.4.5.6.7.8.9. Capital Stock IINEINENE1NENE Additional Paid-in Capital NEINEINENENENENE Retained Earnings NENENEDD1NENENE

Learning Objectives

- Comprehend the effects of corporate transactions and events on stockholders' equity, including stock issuance, dividends, and stock splits.

Related questions

Net Income Decreases When Treasury Stock Is Sold for an ...

There Would Be 100,000 Shares of Common Stock Outstanding When ...

Total Stockholders' Equity of Grasse Company Is Not Affected When ...

From an Accounting Standpoint, Stock Splits Are Accomplished By ...

Which of the Following Are Realistic Motives for a Stock ...