Asked by Parker Stanger on Jun 09, 2024

Verified

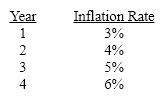

Economists forecast the following inflation rates for the next four years:  What inflation adjustment should be included in the interest rate on a three-year loan made today?

What inflation adjustment should be included in the interest rate on a three-year loan made today?

A) 3%, because that's the rate at the time the loan is made and borrowers won't pay any more

B) 4%, because that's the average expected inflation rate over the life of the loan

C) 6%, because that's the rate that will exist when the lender is loaning the money out again

D) 6%, because at a lower rate the lender will have lost purchasing power by the time it lends the money out again

Inflation Adjustment

A modification made to financial statements or figures to account for the effects of inflation.

Inflation Rates

The rate at which the general level of prices for goods and services is rising, leading to a decrease in the purchasing power of money.

Interest Rate

The percentage of a sum of money charged for its use, typically expressed annually.

- Calculate expected inflation impacts on interest rates.

Verified Answer

CG

Carina GarciaJun 12, 2024

Final Answer :

B

Explanation :

The inflation adjustment should reflect the expected average inflation rate over the life of the loan, which in this case is four years. Option A is incorrect because inflation is expected to be higher than 3% over the next four years. Option C is incorrect because it assumes the lender will be lending the money again in three years, while the loan is for three years. Option D is incorrect because it only considers the lender's perspective and does not reflect the average expected inflation rate over the life of the loan.

Learning Objectives

- Calculate expected inflation impacts on interest rates.