Asked by Danielle McBratney on Jul 28, 2024

Verified

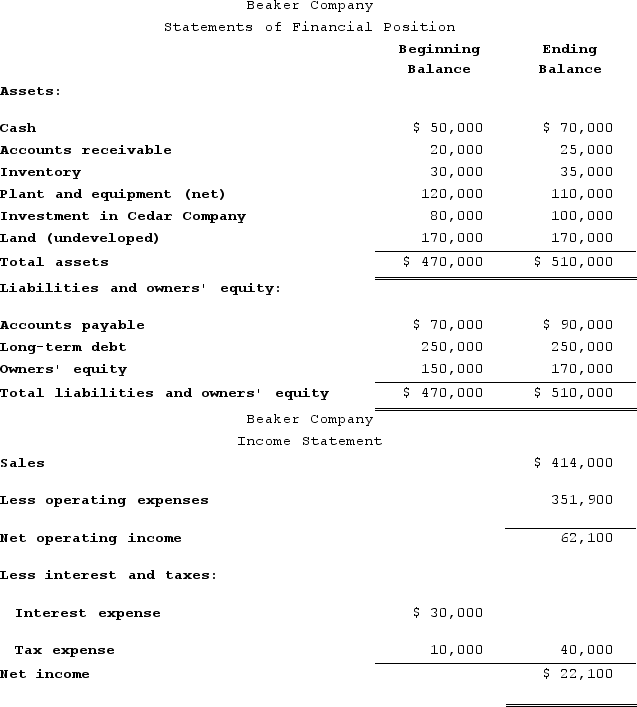

Financial data for Beaker Company for last year appear below:

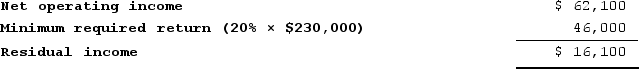

The company paid dividends of $2,100 last year. The "Investment in Cedar Company" on the statement of financial position represents an investment in the stock of another company.Required:a. Compute the company's margin, turnover, and return on investment for last year.b. The Board of Directors of Beaker Company has set a minimum required return of 20%. What was the company's residual income last year?

The company paid dividends of $2,100 last year. The "Investment in Cedar Company" on the statement of financial position represents an investment in the stock of another company.Required:a. Compute the company's margin, turnover, and return on investment for last year.b. The Board of Directors of Beaker Company has set a minimum required return of 20%. What was the company's residual income last year?

Return On Investment (ROI)

A measure used to evaluate the efficiency or profitability of an investment, calculated by dividing the return of the investment by its cost.

Residual Income

The net income that an investment earns beyond the minimum rate of return.

Margin

Generally refers to the difference between the selling price and the cost of a product or service, often expressed as a percentage of the selling price.

- Assess the return on investment (ROI) of a division within a corporate entity.

- Assess and interpret metrics of financial performance, such as margin, turnover, and residual income.

Verified Answer

DQ

Devin QuickAug 01, 2024

Final Answer :

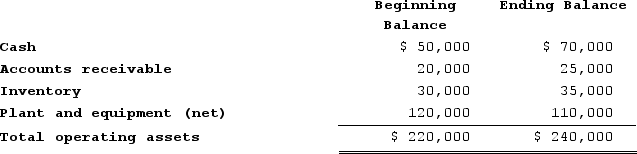

a.Operating assets do not include investments in other companies or in undeveloped land.

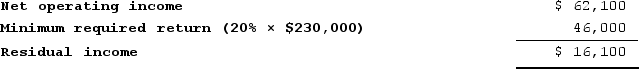

Average operating assets = ($220,000 + $240,000) ÷ 2 = $230,000Margin = Net operating income ÷ Sales= $62,100 ÷ $414,000 = 15%Turnover = Sales ÷ Average operating assets= $414,000 ÷ $230,000 = 1.8Return on investment = Margin × Turnover= 15% × 1.8 = 27%b.

Average operating assets = ($220,000 + $240,000) ÷ 2 = $230,000Margin = Net operating income ÷ Sales= $62,100 ÷ $414,000 = 15%Turnover = Sales ÷ Average operating assets= $414,000 ÷ $230,000 = 1.8Return on investment = Margin × Turnover= 15% × 1.8 = 27%b.

Average operating assets = ($220,000 + $240,000) ÷ 2 = $230,000Margin = Net operating income ÷ Sales= $62,100 ÷ $414,000 = 15%Turnover = Sales ÷ Average operating assets= $414,000 ÷ $230,000 = 1.8Return on investment = Margin × Turnover= 15% × 1.8 = 27%b.

Average operating assets = ($220,000 + $240,000) ÷ 2 = $230,000Margin = Net operating income ÷ Sales= $62,100 ÷ $414,000 = 15%Turnover = Sales ÷ Average operating assets= $414,000 ÷ $230,000 = 1.8Return on investment = Margin × Turnover= 15% × 1.8 = 27%b.

Learning Objectives

- Assess the return on investment (ROI) of a division within a corporate entity.

- Assess and interpret metrics of financial performance, such as margin, turnover, and residual income.