Asked by Eunice Gwendolyn on May 19, 2024

Verified

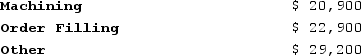

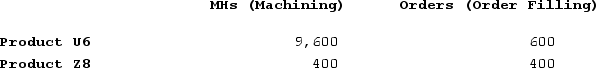

Flemming Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Machining, Order Filling, and Other. The costs in those activity cost pools appear below:  Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

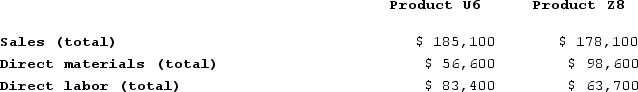

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

What is the product margin for Product U6 under activity-based costing?

What is the product margin for Product U6 under activity-based costing?

A) $45,100

B) $11,296

C) $25,036

D) $8,600

Product Margin

The difference between the selling price of a product and its production costs, indicating the profitability of a product.

Activity-Based Costing

A method of allocating costs to products and services based on the activities that contribute to those costs instead of on traditional measures like machine hours.

- Determine the margins on products through Activity-Based Costing.

Verified Answer

Machining costs:

Product U6 requires 20 MHs of machining. The total machining cost is $171,000. Therefore, the machining cost allocated to Product U6 is:

(20 MHs ÷ 1,500 MHs) x $171,000 = $2,280

Order Filling costs:

Product U6 was ordered 40 times. The total order filling cost is $80,000. Therefore, the order filling cost allocated to Product U6 is:

(40 orders ÷ 1,000 orders) x $80,000 = $3,200

Direct costs for Product U6 are $35,000.

Therefore, the total product cost for U6 is:

$2,280 + $3,200 + $35,000 = $40,480

The sale price for Product U6 is $51,776.

Therefore, the product margin for U6 is:

$51,776 - $40,480 = $11,296

Therefore, the answer is choice B.

Learning Objectives

- Determine the margins on products through Activity-Based Costing.

Related questions

Bachrodt Corporation Uses Activity-Based Costing to Compute Product Margins ...

Musich Corporation Has an Activity-Based Costing System with Three Activity ...

Neas Corporation Has an Activity-Based Costing System with Three Activity ...

Greife Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Machining ...

Zwahlen Corporation Has an Activity-Based Costing System with Three Activity ...