Asked by Mansi Sharma on Jun 02, 2024

Verified

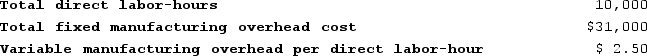

Florek Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:

Required:a. Calculate the estimated total manufacturing overhead for the year.b. Calculate the predetermined overhead rate for the year.

Required:a. Calculate the estimated total manufacturing overhead for the year.b. Calculate the predetermined overhead rate for the year.

Predetermined Overhead Rate

A predetermined rate for assigning manufacturing overhead to products, calculated at the start of the period using estimated expenses and levels of activity.

Direct Labor-Hours

Total working hours of employees directly taking part in the production operation or service provision.

Manufacturing Overhead

Refers to all the indirect costs associated with manufacturing, beyond direct labor and materials, such as utilities and rent for the manufacturing space.

- Estimate the annual total manufacturing overhead cost for the year.

- Figure out the predetermined rate for overhead costs annually.

Verified Answer

Learning Objectives

- Estimate the annual total manufacturing overhead cost for the year.

- Figure out the predetermined rate for overhead costs annually.

Related questions

Fillmore Corporation Uses a Job-Order Costing System with a Single ...

The Management of Plitt Corporation Would Like to Investigate the ...

Verry Corporation Uses a Job-Order Costing System with a Single ...

Gercak Corporation Has Two Production Departments, Forming and Assembly ...

Petty Corporation Has Two Production Departments, Milling and Finishing ...