Asked by Anthony Rabbit on Jul 02, 2024

Verified

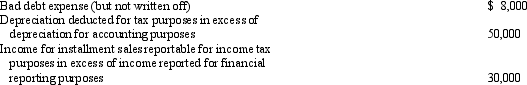

For the year ended December 31, 2010, the Huntsville Company reported income of $350, 000 before provision for income tax.In arriving at taxable income for income tax purposes, the following differences were identified:  Assuming a corporate income tax rate of 30%, Huntsville's current income tax liability as of December 31, 2010, is

Assuming a corporate income tax rate of 30%, Huntsville's current income tax liability as of December 31, 2010, is

A) $ 83, 400

B) $101, 400

C) $113, 400

D) $129, 000

E) none of these

Taxable Income

The amount of income that is subject to income tax after deductions and exemptions.

Corporate Income Tax Rate

The percentage of corporate profits that are paid to the government as income tax.

- Calculate the income tax expense or benefit associated with operating losses.

Verified Answer

SJ

steffenie juliat6 days ago

Final Answer :

B

Explanation :

Huntsville's taxable income for income tax purposes can be calculated by taking the reported income and adding back the expenses that are not deductible for tax purposes, and subtracting any income that is taxable for tax purposes but not reported.

Taxable income = $350,000 + $50,000 - $20,000 = $380,000

Current income tax liability = tax rate x taxable income

Current income tax liability = 0.30 x $380,000 = $114,000

Therefore, the correct answer is B) $101,400. This is because the tax savings from the difference in depreciation expense ($8,000) will lower the tax liability by $2,400 (since the tax rate is 30%) resulting in a final tax liability of $101,400.

Taxable income = $350,000 + $50,000 - $20,000 = $380,000

Current income tax liability = tax rate x taxable income

Current income tax liability = 0.30 x $380,000 = $114,000

Therefore, the correct answer is B) $101,400. This is because the tax savings from the difference in depreciation expense ($8,000) will lower the tax liability by $2,400 (since the tax rate is 30%) resulting in a final tax liability of $101,400.

Learning Objectives

- Calculate the income tax expense or benefit associated with operating losses.