Asked by Camri Baldwin on Apr 25, 2024

Verified

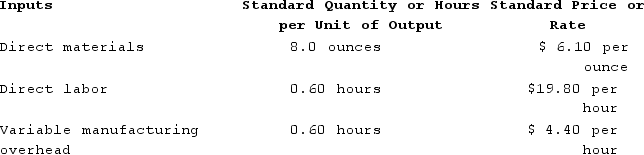

Fortes Incorporated has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.

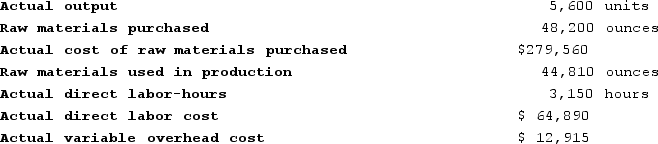

The company has reported the following actual results for the product for April:

The company has reported the following actual results for the product for April:

Required:a. Compute the materials price variance for April.b. Compute the materials quantity variance for April.c. Compute the labor rate variance for April.d. Compute the labor efficiency variance for April.e. Compute the variable overhead rate variance for April.f. Compute the variable overhead efficiency variance for April.

Required:a. Compute the materials price variance for April.b. Compute the materials quantity variance for April.c. Compute the labor rate variance for April.d. Compute the labor efficiency variance for April.e. Compute the variable overhead rate variance for April.f. Compute the variable overhead efficiency variance for April.

Materials Price Variance

The difference between the actual cost of materials used in production and the budgeted cost of materials, based on standard prices and actual quantities purchased.

Variable Manufacturing

Costs in manufacturing that vary directly with the level of production, such as raw materials and direct labor costs.

- Determine diverse kinds of variances, for instance, price and amount variations in materials.

- Ascertain variations in labor rate and effectiveness.

- Work out the variable overhead rate and examine efficiency deviations.

Verified Answer

CP

Chantal Pangan6 days ago

Final Answer :

a.Materials price variance = (Actual quantity × Actual price) − (Actual quantity × Standard price)= $279,560 − (48,200 ounces × $6.10 per ounce)= $279,560 − $294,020= $14,460 Favorableb.Standard quantity = 5,600 units × 8.0 ounces per unit = 44,800 ouncesMaterials quantity variance = (Actual quantity × Standard price) − (Standard quantity × Standard price)= (Actual quantity − Standard quantity) × Standard price= (44,810 ounces − 44,800 ounces) × $6.10 per ounce= 10 ounces × $6.10 per ounce= $61 Unfavorablec.Labor rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)= $64,890 − (3,150 hours × $19.80 per hour)= $64,890 − $62,370= $2,520 Unfavorabled.Standard hours = 5,600 units × 0.60 hours per unit = 3,360 hoursLabor efficiency variance = (Actual hours × Standard rate) - (Standard hours × Standard rate)= (Actual hours − Standard hours) × Standard Rate= (3,150 hours − 3,360 hours) × $19.80 per hour= (−210 hours) × $19.80 per hour= $4,158 Favorablee.Variable overhead rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)= $12,915 − (3,150 hours × $4.40 per hour)= $12,915 − ($13,860)= $945 Favorablef.Standard hours = 5,600 units × 0.60 hours per unit = 3,360 hoursVariable overhead efficiency variance = (Actual hours × Standard rate) − (Standard hours × Standard rate)= (Actual hours − Standard hours) × Standard rate= (3,150 hours − 3,360 hours) × $4.40 per hour= (−210 hours) × $4.40 per hour= $924 Favorable

Learning Objectives

- Determine diverse kinds of variances, for instance, price and amount variations in materials.

- Ascertain variations in labor rate and effectiveness.

- Work out the variable overhead rate and examine efficiency deviations.

Related questions

Bondi Corporation Makes Automotive Engines ...

Kropf Incorporated Has Provided the Following Data Concerning One of ...

Glaab Incorporated Has Provided the Following Data Concerning One of ...

Mirabito Incorporated Has Provided the Following Data Concerning One of ...

The Standards for Product G78V Specify 4 ...