Asked by Dustin Hedrick on Apr 26, 2024

Verified

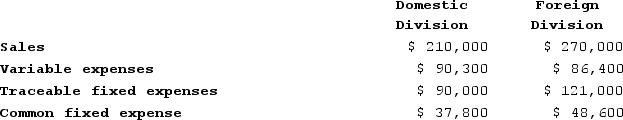

Gardella Corporation has two divisions: Domestic Division and Foreign Division. The following data are for the most recent operating period:  The common fixed expenses have been allocated to the divisions on the basis of sales.The company's overall break-even sales is closest to:

The common fixed expenses have been allocated to the divisions on the basis of sales.The company's overall break-even sales is closest to:

A) $449,317

B) $134,827

C) $470,663

D) $335,836

Break-Even Sales

The amount of revenue from sales at which a business covers its costs, without making a profit or incurring a loss.

Common Fixed Expenses

Overheads that are consistent in amount across different business segments, departments, or products.

Operating Period

The time frame during which a business operates to achieve its set objectives, which can be measured daily, monthly, quarterly, or annually.

- Learn and employ the theory of break-even sales when analyzing segments.

Verified Answer

Domestic Division break-even point = $242,000 ÷ (1 - 0.4 - 0.2) = $242,000 ÷ 0.4 = $605,000

Foreign Division break-even point = $214,000 ÷ (1 - 0.3 - 0.1) = $214,000 ÷ 0.6 = $356,667

Total break-even point = $605,000 + $356,667 = $961,667

To calculate the overall sales amount, we need to divide the total fixed expense by the overall contribution margin ratio:

Overall contribution margin ratio = (($605,000 × 0.6) + ($356,667 × 0.7)) ÷ (($605,000 + $242,000) + ($356,667 + $214,000)) = $660,667 ÷ $1,417,667 = 0.466

Overall fixed expense = $242,000 + $214,000 = $456,000

Overall break-even sales = $456,000 ÷ 0.466 = $978,731, rounded to the nearest thousand = $470,663

Therefore, the best choice is C.

Learning Objectives

- Learn and employ the theory of break-even sales when analyzing segments.

Related questions

The Company's Overall Break-Even Sales Is Closest To

The Retail Division's Break-Even Sales Is Closest To

Kopec Corporation Manufactures Numerous Products, One of Which Is Called ...

Northern Pacific Fixtures Corporation Sells a Single Product for $28 ...

Data Concerning Buchenau Corporation's Single Product Appear Below: the ...