Asked by Stephan Polit on May 11, 2024

Verified

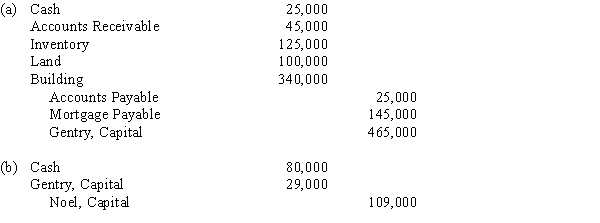

Gentry, sole proprietor of a hardware business, decides to form a partnership with Noel. Gentry's accounts are as follows:? Book Value Market Value Cash $25,000$25,000 Accounts Receivable (net) 52,00045,000 Inventory 112,000125,000 Land 40,000100,000 Buil ding (net) 300,000340,000 Accounts Payable 25,00025,000 Mortgage Payable 145,000145,000\begin{array}{lrr} & \text { Book Value } & \text { Market Value } \\\text { Cash } & \$ 25,000 & \$ 25,000 \\\text { Accounts Receivable (net) } & 52,000 & 45,000 \\\text { Inventory } & 112,000 & 125,000 \\\text { Land } & 40,000 & 100,000 \\\text { Buil ding (net) } & 300,000 & 340,000 \\\text { Accounts Payable } & 25,000 & 25,000 \\\text { Mortgage Payable } & 145,000 & 145,000\end{array} Cash Accounts Receivable (net) Inventory Land Buil ding (net) Accounts Payable Mortgage Payable Book Value $25,00052,000112,00040,000300,00025,000145,000 Market Value $25,00045,000125,000100,000340,00025,000145,000 Noel agrees to contribute $80,000 for a 20% interest. Journalize the entries to record

(a) Gentry's investment and

(b) Noel's investment.

Market Value

The amount for which something can be sold in a given market at a particular time.

Book Value

The net value of a company's assets minus its liabilities, as reported on the balance sheet, often used to assess a company's financial health.

Mortgage Payable

A long-term liability on a balance sheet, representing money owed on a property loan that is to be paid back over time.

- Employ bookkeeping practices for documenting the admission of a new partner into a partnership.

- Explore how variations in partnership composition influence capital accounts and interests of ownership.

Verified Answer

AR

Learning Objectives

- Employ bookkeeping practices for documenting the admission of a new partner into a partnership.

- Explore how variations in partnership composition influence capital accounts and interests of ownership.

Related questions

Watson Purchased One-Half of Dalton's Interest in the Patton and ...

The Capital Accounts of Hope and Indiana Have Balances of ...

Brad Simmons, Sole Proprietor of a Hardware Business, Decides to ...

Kala and Leah, Partners in Best Designs, Have Capital Balances ...

If a New Partner Is to Be Admitted to a ...