Asked by caswel mduduzi on Jul 07, 2024

Verified

Going Green, Inc.had 18, 000 shares of common stock outstanding on January 1.An additional 6, 000 shares were issued on May 1.The company also had 1, 000 shares of 5.5%, $100 par, convertible preferred stock outstanding during the year.Each share is convertible into 8 shares of common stock.Net income for the year was $82, 500.

Required:

Compute the appropriate earnings per share amount(s)that would appear on the Going Green's income statement.

Convertible Preferred Stock

A type of preferred stock that gives the holder the right to convert their shares into a predetermined number of common stock shares, usually after a specific date.

- Identify and tally basic and diluted earnings per share (EPS).

Verified Answer

ZK

Zybrea KnightJul 08, 2024

Final Answer :

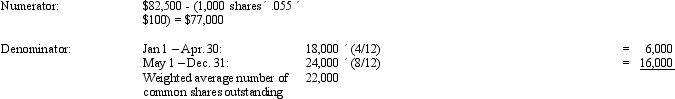

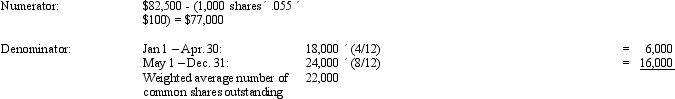

Basic earnings per share:  Basic earnings per share: $77, 000/22, 000 shares = $3.50 Diluted earnings per share: Numerator: $82,500 Denominator: 22,000 shares +(1,000′8)=30,000 shares \begin{array}{ll}\text { Numerator: } & \$ 82,500 \\\text { Denominator: } & 22,000 \text { shares }+(1,000 ' 8)=30,000 \text { shares }\end{array} Numerator: Denominator: $82,50022,000 shares +(1,000′8)=30,000 shares

Basic earnings per share: $77, 000/22, 000 shares = $3.50 Diluted earnings per share: Numerator: $82,500 Denominator: 22,000 shares +(1,000′8)=30,000 shares \begin{array}{ll}\text { Numerator: } & \$ 82,500 \\\text { Denominator: } & 22,000 \text { shares }+(1,000 ' 8)=30,000 \text { shares }\end{array} Numerator: Denominator: $82,50022,000 shares +(1,000′8)=30,000 shares

Diluted earnings per share: $82, 500/30, 000 shares = $2.75

Basic earnings per share: $77, 000/22, 000 shares = $3.50 Diluted earnings per share: Numerator: $82,500 Denominator: 22,000 shares +(1,000′8)=30,000 shares \begin{array}{ll}\text { Numerator: } & \$ 82,500 \\\text { Denominator: } & 22,000 \text { shares }+(1,000 ' 8)=30,000 \text { shares }\end{array} Numerator: Denominator: $82,50022,000 shares +(1,000′8)=30,000 shares

Basic earnings per share: $77, 000/22, 000 shares = $3.50 Diluted earnings per share: Numerator: $82,500 Denominator: 22,000 shares +(1,000′8)=30,000 shares \begin{array}{ll}\text { Numerator: } & \$ 82,500 \\\text { Denominator: } & 22,000 \text { shares }+(1,000 ' 8)=30,000 \text { shares }\end{array} Numerator: Denominator: $82,50022,000 shares +(1,000′8)=30,000 shares Diluted earnings per share: $82, 500/30, 000 shares = $2.75

Learning Objectives

- Identify and tally basic and diluted earnings per share (EPS).

Related questions

Dave Company Had 30, 000 Shares of Common Stock Outstanding ...

Basic Earnings Per Share Is Computed as ...

On January 1, a Corporation Had 10, 380 Shares of ...

The Following Information Has Been Obtained from the Mastic Corporation ...

Which of the Following Statements Regarding Earnings Per Share Is ...