Asked by Jasmine Nacole on Jun 06, 2024

Verified

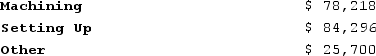

Greife Corporation's activity-based costing system has three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs have already been allocated to these cost pools as follows:

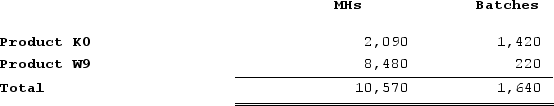

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

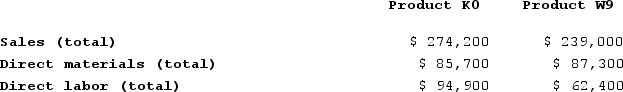

Additional data concerning the company's products appears below:

Additional data concerning the company's products appears below:

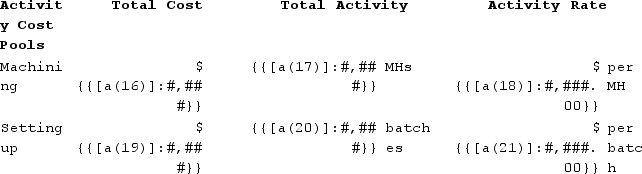

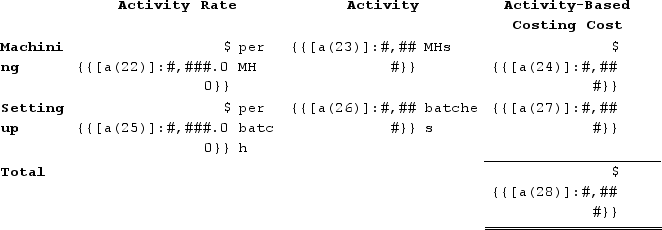

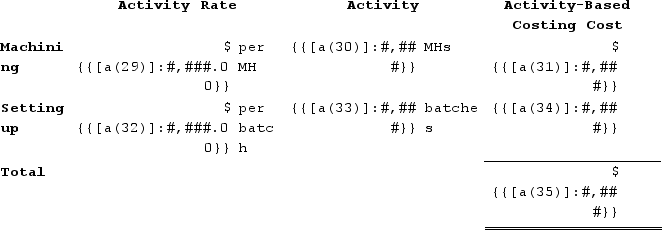

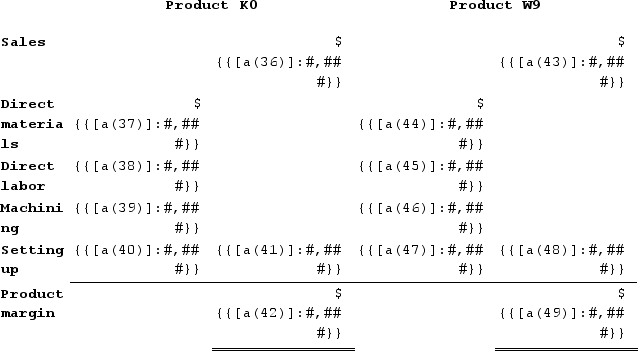

Required:a. Calculate activity rates for each activity cost pool using activity-based costing. (Round your answers to 2 decimal places.) b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. (Round intermediate calculations to 2 decimal places.) c. Determine the product margins for each product using activity-based costing. (Round intermediate calculations to 2 decimal places.)

Required:a. Calculate activity rates for each activity cost pool using activity-based costing. (Round your answers to 2 decimal places.) b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. (Round intermediate calculations to 2 decimal places.) c. Determine the product margins for each product using activity-based costing. (Round intermediate calculations to 2 decimal places.)

Activity-Based Costing

A method of allocating costs to products and services based on the activities they require.

Activity Cost Pools

Groups of costs categorized based on the activities that incur the cost, used in activity-based costing.

Machine-Hours

A measure used in accounting to allocate manufacturing overhead costs to each unit of production, representing the number of hours a machine is operated.

- Distinguish the core concepts of Activity-Based Costing (ABC).

- Determine the cost per activity rates for various pools within an ABC system.

- Allocate overhead costs among products by applying determined activity rates.

Verified Answer

b. Assign overhead costs to products:Overhead cost for Product K0:

b. Assign overhead costs to products:Overhead cost for Product K0: Overhead cost for Product W9:

Overhead cost for Product W9: c. Determine product margins:

c. Determine product margins:

Learning Objectives

- Distinguish the core concepts of Activity-Based Costing (ABC).

- Determine the cost per activity rates for various pools within an ABC system.

- Allocate overhead costs among products by applying determined activity rates.

Related questions

Desjarlais Corporation Uses the Following Activity Rates from Its Activity-Based ...

Archie Corporation Uses the Following Activity Rates from Its Activity-Based ...

Daston Company Manufactures Two Products, Product F and Product G ...

Kretlow Corporation Has Provided the Following Data from Its Activity-Based ...

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...