Asked by Michael Covino on Jul 05, 2024

Verified

Guerra, Inc.adopted the dollar-value LIFO retail inventory method on January 1, 2010, when the price index was 100.The following information was taken from company records on December 31, 2010, when the price index was 110.

Cost Retail Sales $190,000 Additional markps 18,000 Markup cancellations 6,000 Markdowns 8,000 Markdown cancellations 2,000 Inventory, January 1 $14,40020,000 Purchases 158,000199,000 Purchase returns 4,0005,000\begin{array}{lll}&\text { Cost}&\text { Retail}\\\text { Sales } & & \$ 190,000 \\\text { Additional markps } & & 18,000 \\\text { Markup cancellations } & & 6,000 \\\text { Markdowns } & & 8,000 \\\text { Markdown cancellations } & & 2,000 \\\text { Inventory, January 1 } & \$ 14,400 & 20,000 \\\text { Purchases } & 158,000 & 199,000 \\\text { Purchase returns } & 4,000 & 5,000\end{array} Sales Additional markps Markup cancellations Markdowns Markdown cancellations Inventory, January 1 Purchases Purchase returns Cost$14,400158,0004,000 Retail$190,00018,0006,0008,0002,00020,000199,0005,000 Required:

Compute the cost of the December 31, 2010, inventory.(Round off calculations to the nearest dollar.)

Price Index

A Price Index measures the average change in prices over time for a basket of goods and services, used to assess inflation or deflation in an economy.

Inventory Cost

The cost associated with acquiring, storing, and managing inventory including purchase price, warehousing, and handling costs.

- Gain insight into the employment and merits of the retail inventory system.

Verified Answer

SN

Stephen NagatoshiJul 10, 2024

Final Answer :

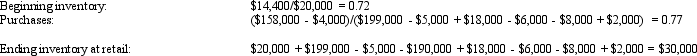

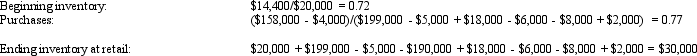

Cost of inventory = $20, 560, determined as follows: Cost percentages:  Ending inventory at retal at base year prices: 30,000/1.10=27,273 Inventory change at retail at base year prices:27,273−20,000=7,273Inventory change at retail at relevant current prices:7,273′1.10=8,000Inventory change at current costs: 8,000′0.77=6,160\begin{array}{lr}\text {Ending inventory at retal at base year prices: }&30,000 / 1.10=27,273\\\text { Inventory change at retail at base year prices:}&27,273-20,000=7,273\\\text {Inventory change at retail at relevant current prices:}&7,273 ' 1.10=8,000\\\text {Inventory change at current costs: }&8,000 ' 0.77=6,160\\\end{array}Ending inventory at retal at base year prices: Inventory change at retail at base year prices:Inventory change at retail at relevant current prices:Inventory change at current costs: 30,000/1.10=27,27327,273−20,000=7,2737,273′1.10=8,0008,000′0.77=6,160

Ending inventory at retal at base year prices: 30,000/1.10=27,273 Inventory change at retail at base year prices:27,273−20,000=7,273Inventory change at retail at relevant current prices:7,273′1.10=8,000Inventory change at current costs: 8,000′0.77=6,160\begin{array}{lr}\text {Ending inventory at retal at base year prices: }&30,000 / 1.10=27,273\\\text { Inventory change at retail at base year prices:}&27,273-20,000=7,273\\\text {Inventory change at retail at relevant current prices:}&7,273 ' 1.10=8,000\\\text {Inventory change at current costs: }&8,000 ' 0.77=6,160\\\end{array}Ending inventory at retal at base year prices: Inventory change at retail at base year prices:Inventory change at retail at relevant current prices:Inventory change at current costs: 30,000/1.10=27,27327,273−20,000=7,2737,273′1.10=8,0008,000′0.77=6,160

Layers Cost $14,4006,160$20,560\begin{array}{l}\text { Layers } \\\text { Cost } \\\$ 14,400 \\6,160 \\\hline\$ 20,560\end{array} Layers Cost $14,4006,160$20,560

Ending inventory at retal at base year prices: 30,000/1.10=27,273 Inventory change at retail at base year prices:27,273−20,000=7,273Inventory change at retail at relevant current prices:7,273′1.10=8,000Inventory change at current costs: 8,000′0.77=6,160\begin{array}{lr}\text {Ending inventory at retal at base year prices: }&30,000 / 1.10=27,273\\\text { Inventory change at retail at base year prices:}&27,273-20,000=7,273\\\text {Inventory change at retail at relevant current prices:}&7,273 ' 1.10=8,000\\\text {Inventory change at current costs: }&8,000 ' 0.77=6,160\\\end{array}Ending inventory at retal at base year prices: Inventory change at retail at base year prices:Inventory change at retail at relevant current prices:Inventory change at current costs: 30,000/1.10=27,27327,273−20,000=7,2737,273′1.10=8,0008,000′0.77=6,160

Ending inventory at retal at base year prices: 30,000/1.10=27,273 Inventory change at retail at base year prices:27,273−20,000=7,273Inventory change at retail at relevant current prices:7,273′1.10=8,000Inventory change at current costs: 8,000′0.77=6,160\begin{array}{lr}\text {Ending inventory at retal at base year prices: }&30,000 / 1.10=27,273\\\text { Inventory change at retail at base year prices:}&27,273-20,000=7,273\\\text {Inventory change at retail at relevant current prices:}&7,273 ' 1.10=8,000\\\text {Inventory change at current costs: }&8,000 ' 0.77=6,160\\\end{array}Ending inventory at retal at base year prices: Inventory change at retail at base year prices:Inventory change at retail at relevant current prices:Inventory change at current costs: 30,000/1.10=27,27327,273−20,000=7,2737,273′1.10=8,0008,000′0.77=6,160 Layers Cost $14,4006,160$20,560\begin{array}{l}\text { Layers } \\\text { Cost } \\\$ 14,400 \\6,160 \\\hline\$ 20,560\end{array} Layers Cost $14,4006,160$20,560

Learning Objectives

- Gain insight into the employment and merits of the retail inventory system.

Related questions

The Retail Inventory Method Is Used Extensively in the Retail ...

Davies Adopted the Dollar-Value LIFO Retail Inventory Method on January ...

If a Fire Destroys the Inventory, the Gross Profit Method ...

The Lower of Cost or Market Rule for Inventory Valuation ...

Which One of the Following Statements Is Not True Concerning ...