Asked by Sheree Rouse on May 03, 2024

Verified

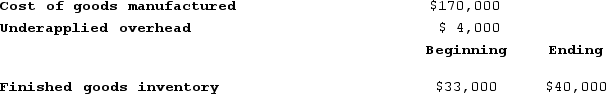

Gurtner Corporation has provided the following data concerning last month's operations.  Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold.

Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold.

How much is the adjusted cost of goods sold on the Schedule of Cost of Goods Sold?

A) $170,000

B) $167,000

C) $203,000

D) $163,000

Adjusted Cost of Goods Sold

The cost of goods sold that has been adjusted for changes in inventory levels or valuation methods.

Overapplied Manufacturing Overhead

A situation where the allocated amount of manufacturing overhead costs exceeds the actual overhead costs incurred.

- Understand the adjustment of manufacturing overhead to Cost of Goods Sold.

Verified Answer

DP

Doan Phi HoangMay 10, 2024

Final Answer :

B

Explanation :

The adjusted cost of goods sold can be calculated as follows:

Beginning WIP inventory + Total manufacturing costs - Ending WIP inventory = Cost of goods manufactured

$18,000 + $160,000 - $12,000 = $166,000

Then, to account for any underapplied or overapplied overhead, we add or subtract the amount to/from the cost of goods manufactured:

$166,000 + $1,000 = $167,000

Therefore, the adjusted cost of goods sold is $167,000.

Beginning WIP inventory + Total manufacturing costs - Ending WIP inventory = Cost of goods manufactured

$18,000 + $160,000 - $12,000 = $166,000

Then, to account for any underapplied or overapplied overhead, we add or subtract the amount to/from the cost of goods manufactured:

$166,000 + $1,000 = $167,000

Therefore, the adjusted cost of goods sold is $167,000.

Learning Objectives

- Understand the adjustment of manufacturing overhead to Cost of Goods Sold.

Related questions

Holmstrom Corporation Has Provided the Following Data Concerning Last Month's ...

Underapplied Overhead I. Describe How Overhead May Be Underapplied ...

Kesterson Corporation Has Provided the Following Information: If 4,000 ...

Schwiesow Corporation Has Provided the Following Information: If 7,000 ...

The Following Accounts Are from Last Year's Books at Sharp ...