Asked by Madison Schmitz on Apr 25, 2024

Verified

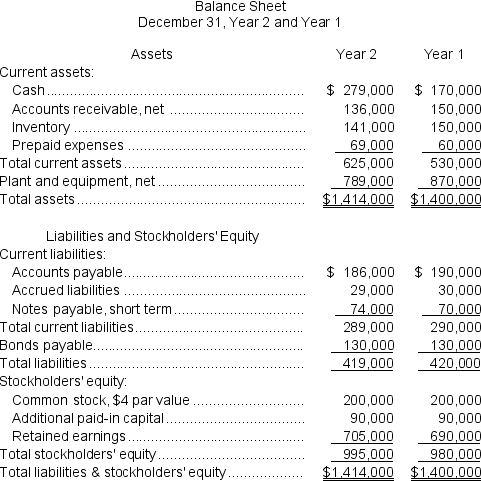

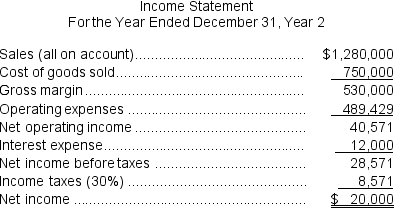

Hagle Corporation has provided the following financial data:

Required:

Required:

a.What is the company's accounts receivable turnover for Year 2?

b.What is the company's average collection period for Year 2?

c.What is the company's inventory turnover for Year 2?

d.What is the company's average sale period for Year 2?

e.What is the company's operating cycle for Year 2?

f.What is the company's total asset turnover for Year 2?

Operating Cycle

The duration of time it takes for a company to purchase inventory, sell products, and collect cash from customers.

Average Collection Period

The average number of days it takes for a company to receive payments owed by its customers, indicating the effectiveness of its credit and collection policies.

Inventory Turnover

A figure representing the frequency at which a business's stock is both sold and refilled over an assigned period, showing the adeptness of inventory administration.

- Perceive and implement a range of financial ratios to evaluate the financial health of a company.

- Evaluate the turnover of inventory to measure the proficiency of inventory management practices.

- Quantify the return on total assets (ROA) to scrutinize how well a company applies its assets to generate financial gain.

Verified Answer

= $1,280,000 ÷ $143,000 = 8.95 (rounded)

*Average accounts receivable =

($136,000 + $150,000)÷ 2 = $143,000

b.Average collection period = 365 days ÷ Accounts receivable turnover

= 365 days ÷ 8.95 = 40.8 days (rounded)

c.Inventory turnover = Cost of goods sold ÷ Average inventory*

= $750,000 ÷ $145,500 = 5.15 (rounded)

*Average inventory = ($141,000 + $150,000)÷ 2 = $145,500

d.Average sale period = 365 days ÷ Inventory turnover

= 365 days ÷ 5.15 = 70.9 days (rounded)

e.Operating cycle = Average sale period + Average collection period

= 70.9 days + 40.8 days = 111.7 days

f.Total asset turnover = Sales ÷ Average total assets*

= $1,280,000 ÷ $1,407,000 = 0.91 (rounded)

*Average total assets = ($1,414,000 + $1,400,000)÷ 2 = $1,407,000

Learning Objectives

- Perceive and implement a range of financial ratios to evaluate the financial health of a company.

- Evaluate the turnover of inventory to measure the proficiency of inventory management practices.

- Quantify the return on total assets (ROA) to scrutinize how well a company applies its assets to generate financial gain.

Related questions

Remley Corporation Has Provided the Following Financial Data ...

Gehlhausen Corporation Has Provided the Following Financial Data ...

Sidell Corporation's Most Recent Balance Sheet and Income Statement Appear ...

Which One of the Following Ratios Helps to Indicate a ...

Based Upon the Following Information, Which Company Has the Best ...