Asked by Jessica Leigh on Apr 24, 2024

Verified

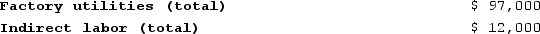

Hagy Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. The company's overhead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Data concerning the company's costs and activity-based costing system appear below:

Distribution of Resource Consumption Across Activity Cost Pools

Distribution of Resource Consumption Across Activity Cost Pools

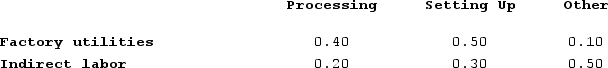

Required:Assign overhead costs to activity cost pools using activity-based costing.

Required:Assign overhead costs to activity cost pools using activity-based costing.

Overhead Costs

Indirect costs incurred during the production process or in the performance of services, not directly tied to a specific product or service.

Activity Cost Pools

Groupings of individual costs, typically by department or activity, used in activity-based costing to allocate costs to products or services.

- Implement activity-based costing to ensure precise distribution of indirect costs to products.

Verified Answer

![Assign overhead costs to activity cost pools by applying the percentages in the Distribution of Resource Consumption Across Activity Cost Pools table to the respective costs. For example, the first entry in the table is computed as follows: ${{[a(1)]:#,###}} × {{[a(3)]:#,##0.00}} = ${{[a(9)]:#,###}}.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61a7_473e_bf83_d9a2603d4734_TB8314_00.jpg)

Learning Objectives

- Implement activity-based costing to ensure precise distribution of indirect costs to products.

Related questions

Howell Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Machining ...

Desilets Corporation Has Provided the Following Data from Its Activity-Based ...

Beckley Corporation Has Provided the Following Data from Its Activity-Based ...

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...

Musich Corporation Has an Activity-Based Costing System with Three Activity ...