Asked by nikki scalera on Jun 06, 2024

Verified

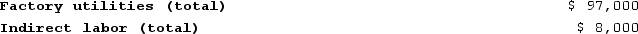

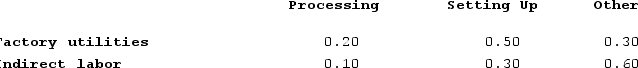

Hagy Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. The company's overhead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Data concerning the company's costs and activity-based costing system appear below:

Distribution of Resource Consumption Across Activity Cost Pools

Distribution of Resource Consumption Across Activity Cost Pools

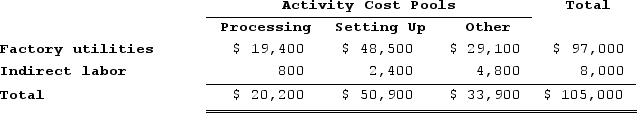

Required:Assign overhead costs to activity cost pools using activity-based costing.

Required:Assign overhead costs to activity cost pools using activity-based costing.

Activity-Based Costing

A method of allocating costs to products and services based on the activities they require, aiming to provide more accurate cost information.

Factory Utilities

Expenses related to utilities such as electricity, gas, and water, used in the operation of a manufacturing facility.

Indirect Labor

The wages paid to employees who support the production process but are not directly involved in the creation of the product or service.

- Develop an understanding of the fundamentals of Activity-Based Costing (ABC).

- Distribute overhead expenditures to activity cost pools based on the usage of resources.

Verified Answer

Learning Objectives

- Develop an understanding of the fundamentals of Activity-Based Costing (ABC).

- Distribute overhead expenditures to activity cost pools based on the usage of resources.

Related questions

Desjarlais Corporation Uses the Following Activity Rates from Its Activity-Based ...

Archie Corporation Uses the Following Activity Rates from Its Activity-Based ...

Kretlow Corporation Has Provided the Following Data from Its Activity-Based ...

Greife Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Machining ...

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...