Asked by Justin Brady on May 16, 2024

Verified

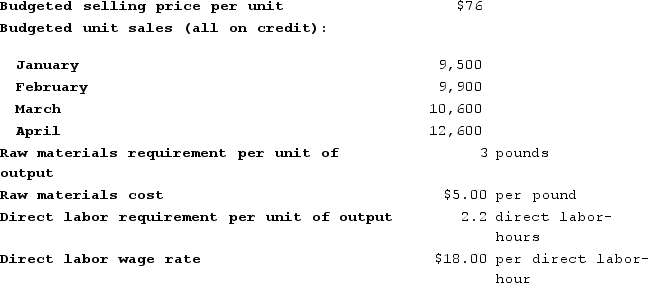

Hennagir Corporation makes one product and has provided the following information to help prepare the master budget for the next four months of operations:

Master Budget

A comprehensive financial plan made up of several individual budgets that represent the company's operations and financial goals for a specific period.

Product

An item or service created through a process of manufacturing or production, intended for sale or use by consumers.

- Build thorough master budgets, with sections dedicated to sales, production, and cash management.

Verified Answer

JJ

Jesse JohnsonMay 22, 2024

Final Answer :

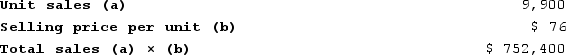

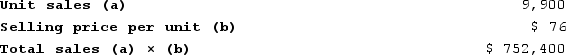

a. The budgeted sales for February are computed as follows:

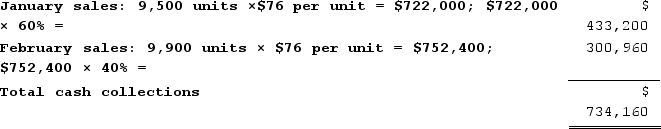

b. The expected cash collections for February are computed as follows:

b. The expected cash collections for February are computed as follows:

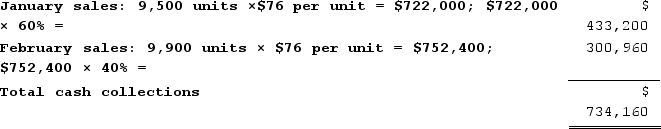

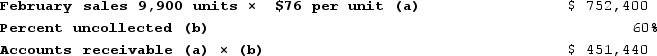

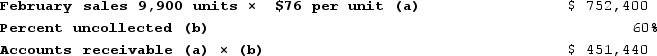

c. The budgeted accounts receivable balance at the end of February is:

c. The budgeted accounts receivable balance at the end of February is:

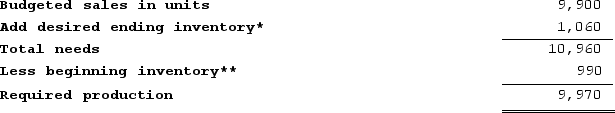

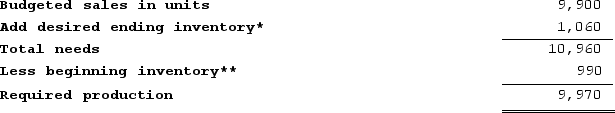

d. The budgeted required production for February is computed as follows:

d. The budgeted required production for February is computed as follows:

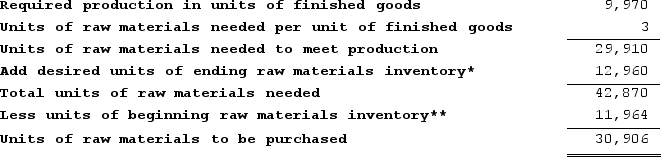

*March sales of 10,600 units × 10% = 1,060 units** February sales of 9,900 units × 10%= 990 unitse. The budgeted raw material purchases for February are computed as follows:

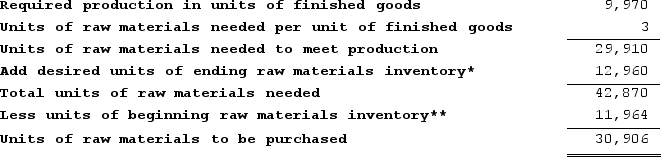

*March sales of 10,600 units × 10% = 1,060 units** February sales of 9,900 units × 10%= 990 unitse. The budgeted raw material purchases for February are computed as follows:

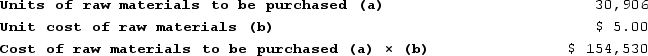

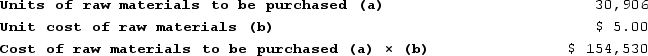

* 32,400 pounds × 40% = 12,960 pounds.** 29,910 pounds × 40% = 11,964 pounds.f. The budgeted cost of raw material purchases for February is computed as follows:

* 32,400 pounds × 40% = 12,960 pounds.** 29,910 pounds × 40% = 11,964 pounds.f. The budgeted cost of raw material purchases for February is computed as follows:

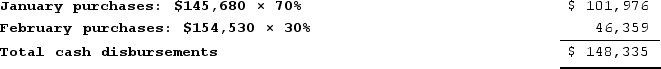

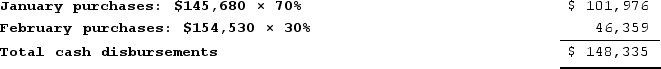

g. The estimated cash disbursements for materials purchases in February is computed as follows:

g. The estimated cash disbursements for materials purchases in February is computed as follows:

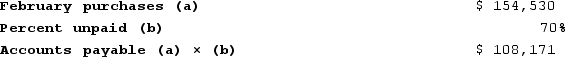

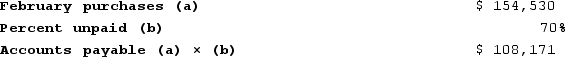

h. The budgeted accounts payable balance at the end of February is:

h. The budgeted accounts payable balance at the end of February is:

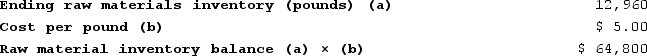

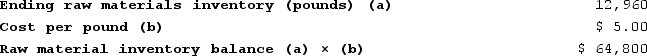

i. The estimated raw materials inventory balance at the end of February is computed as follows:

i. The estimated raw materials inventory balance at the end of February is computed as follows:

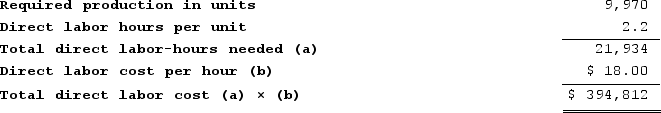

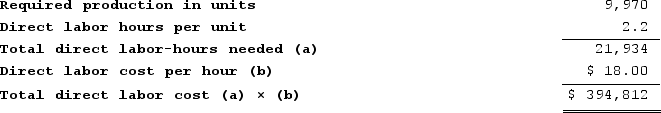

j. The estimated direct labor cost for February is computed as follows:

j. The estimated direct labor cost for February is computed as follows:

Credit sales are collected:

Credit sales are collected:

40% in the month of the sale

60% in the following monthRaw materials purchases are paid:

30% in the month of purchase

70% in the following month

The ending finished goods inventory should equal 10% of the following month's sales. The ending raw materials inventory should equal 40% of the following month's raw materials production needs.Required:a. What are the budgeted sales for February?b. What are the expected cash collections for February?c. What is the budgeted accounts receivable balance at the end of February?d. According to the production budget, how many units should be produced in February?e. If 32,400 pounds of raw materials are needed for production in March, how many pounds of raw materials should be purchased in February?f. What is the estimated cost of raw materials purchases for February?g. If the cost of raw material purchases in January is $145,680, then in February what are the total estimated cash disbursements for raw materials purchases?h. What is the estimated accounts payable balance at the end of February?i. What is the estimated raw materials inventory balance at the end of February?j. What is the total estimated direct labor cost for February assuming the direct labor workforce is adjusted to match the hours required to produce the forecasted number of units produced?

b. The expected cash collections for February are computed as follows:

b. The expected cash collections for February are computed as follows: c. The budgeted accounts receivable balance at the end of February is:

c. The budgeted accounts receivable balance at the end of February is: d. The budgeted required production for February is computed as follows:

d. The budgeted required production for February is computed as follows: *March sales of 10,600 units × 10% = 1,060 units** February sales of 9,900 units × 10%= 990 unitse. The budgeted raw material purchases for February are computed as follows:

*March sales of 10,600 units × 10% = 1,060 units** February sales of 9,900 units × 10%= 990 unitse. The budgeted raw material purchases for February are computed as follows: * 32,400 pounds × 40% = 12,960 pounds.** 29,910 pounds × 40% = 11,964 pounds.f. The budgeted cost of raw material purchases for February is computed as follows:

* 32,400 pounds × 40% = 12,960 pounds.** 29,910 pounds × 40% = 11,964 pounds.f. The budgeted cost of raw material purchases for February is computed as follows: g. The estimated cash disbursements for materials purchases in February is computed as follows:

g. The estimated cash disbursements for materials purchases in February is computed as follows: h. The budgeted accounts payable balance at the end of February is:

h. The budgeted accounts payable balance at the end of February is: i. The estimated raw materials inventory balance at the end of February is computed as follows:

i. The estimated raw materials inventory balance at the end of February is computed as follows: j. The estimated direct labor cost for February is computed as follows:

j. The estimated direct labor cost for February is computed as follows: Credit sales are collected:

Credit sales are collected:40% in the month of the sale

60% in the following monthRaw materials purchases are paid:

30% in the month of purchase

70% in the following month

The ending finished goods inventory should equal 10% of the following month's sales. The ending raw materials inventory should equal 40% of the following month's raw materials production needs.Required:a. What are the budgeted sales for February?b. What are the expected cash collections for February?c. What is the budgeted accounts receivable balance at the end of February?d. According to the production budget, how many units should be produced in February?e. If 32,400 pounds of raw materials are needed for production in March, how many pounds of raw materials should be purchased in February?f. What is the estimated cost of raw materials purchases for February?g. If the cost of raw material purchases in January is $145,680, then in February what are the total estimated cash disbursements for raw materials purchases?h. What is the estimated accounts payable balance at the end of February?i. What is the estimated raw materials inventory balance at the end of February?j. What is the total estimated direct labor cost for February assuming the direct labor workforce is adjusted to match the hours required to produce the forecasted number of units produced?

Learning Objectives

- Build thorough master budgets, with sections dedicated to sales, production, and cash management.

Related questions

Botz Corporation Makes One Product and It Provided the Following ...

Tilson Corporation Has Projected Sales and Production in Units for ...

Weller Industrial Gas Corporation Supplies Acetylene and Other Compressed Gases ...

Mumbower Corporation Makes One Product and Has Provided the Following ...

Weller Industrial Gas Corporation Supplies Acetylene and Other Compressed Gases ...