Asked by Robyia Spriggins on Jun 16, 2024

Verified

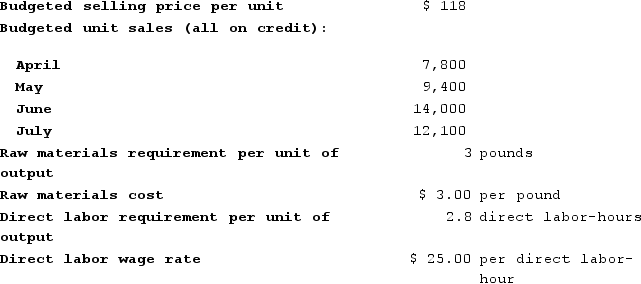

Hesterman Corporation makes one product and has provided the following information to help prepare the master budget for the next four months of operations:  Credit sales are collected:40% in the month of the sale60% in the following monthThe ending finished goods inventory should equal 40% of the following month's sales. The ending raw materials inventory should equal 20% of the following month's raw materials production needs.The expected cash collections for May is closest to:

Credit sales are collected:40% in the month of the sale60% in the following monthThe ending finished goods inventory should equal 40% of the following month's sales. The ending raw materials inventory should equal 20% of the following month's raw materials production needs.The expected cash collections for May is closest to:

A) $920,400

B) $995,920

C) $552,240

D) $443,680

Expected Cash Collections

An estimate of the amount of money a company anticipates receiving from its customers over a certain period, based on sales forecasts and credit policies.

Ending Finished Goods Inventory

The value of goods that have been completed but not yet sold at the end of an accounting period.

Ending Raw Materials Inventory

The value of raw materials that remain unsold and available for use at the end of an accounting period.

- Assess the impact of budgeting on financial decision-making.

Verified Answer

ES

Elizabeth SumerelJun 16, 2024

Final Answer :

B

Explanation :

To calculate expected cash collections for May, we need to first calculate the total sales for May and June, as these are the two months that will affect May's cash collections.

Total sales for May:

Credit sales: $550,000

Cash sales: $220,000 (assuming cash sales are 40% of total sales, since we don't have any other information)

Total sales: $770,000

60% of credit sales for April: $330,000 x 0.6 = $198,000 (this is the amount of credit sales from April that we expect to collect in May)

Expected total cash collections for May: $220,000 (May cash sales) + $198,000 (May collection of April credit sales) = $418,000

Total sales for June:

Credit sales: $605,000

Total sales: $805,000 (assuming cash sales are 40% of total sales)

40% of June sales: $322,000 (this is the amount of credit sales from June that we expect to collect in July)

Ending finished goods inventory for May: 40% of June's sales = $242,000

Ending raw materials inventory for May: 20% of June's raw materials production needs = $77,000

Total expected cash collections for July: $322,000 (June credit collections) + $242,000 (ending finished goods inventory for May) = $564,000

Therefore, the closest option is B) $995,920.

Total sales for May:

Credit sales: $550,000

Cash sales: $220,000 (assuming cash sales are 40% of total sales, since we don't have any other information)

Total sales: $770,000

60% of credit sales for April: $330,000 x 0.6 = $198,000 (this is the amount of credit sales from April that we expect to collect in May)

Expected total cash collections for May: $220,000 (May cash sales) + $198,000 (May collection of April credit sales) = $418,000

Total sales for June:

Credit sales: $605,000

Total sales: $805,000 (assuming cash sales are 40% of total sales)

40% of June sales: $322,000 (this is the amount of credit sales from June that we expect to collect in July)

Ending finished goods inventory for May: 40% of June's sales = $242,000

Ending raw materials inventory for May: 20% of June's raw materials production needs = $77,000

Total expected cash collections for July: $322,000 (June credit collections) + $242,000 (ending finished goods inventory for May) = $564,000

Therefore, the closest option is B) $995,920.

Learning Objectives

- Assess the impact of budgeting on financial decision-making.