Asked by Katherine Lopez on Jul 04, 2024

Verified

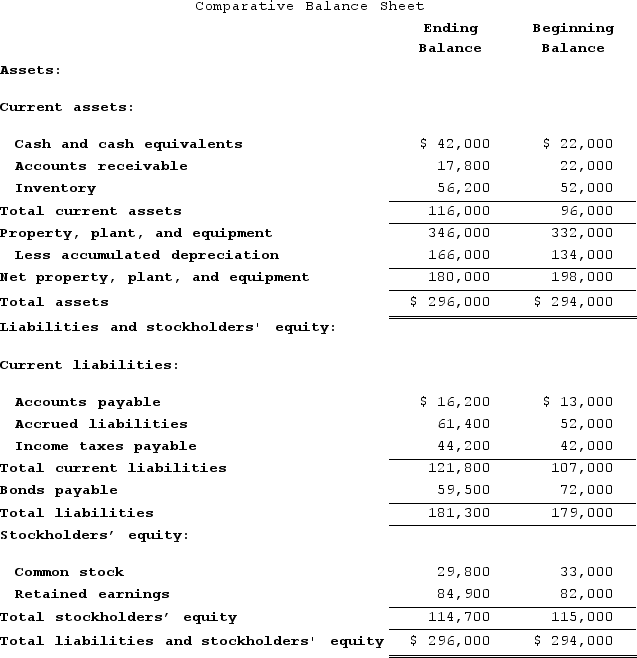

Hirshberg Corporation's comparative balance sheet appears below:  The company's net income for the year was $4,300 and its cash dividends were $1,400. It did not sell or retire any property, plant, and equipment during the year.The company's net cash provided by (used in) investing activities is:v: 02_23_2016_QC_CS-43371

The company's net income for the year was $4,300 and its cash dividends were $1,400. It did not sell or retire any property, plant, and equipment during the year.The company's net cash provided by (used in) investing activities is:v: 02_23_2016_QC_CS-43371

A) $(18,000)

B) $(14,000)

C) $36,200

D) $46,000

Investing Activities

Transactions involving the purchase and sale of long-term assets and other investments, reflected in the cash flow statement.

Comparative Balance Sheet

A comparative balance sheet presents side-by-side information about an entity’s assets, liabilities, and shareholders' equity at multiple points in time, facilitating period-over-period financial analysis.

Cash Dividends

A distribution of a portion of a company's earnings paid in cash to its shareholders, often on a quarterly basis.

- Determine the net amount of cash generated by (or spent on) investing activities.

Verified Answer

Learning Objectives

- Determine the net amount of cash generated by (or spent on) investing activities.

Related questions

Stone Retail Corporation's Most Recent Comparative Balance Sheet Is as ...

Use the Following Information to Calculate the Net Cash Provided ...

Accounts Receivable Arising from Sales to Customers Amounted to $86000 ...

Bush Company Reported Net Income of $60000 for the Year ...

Refer to Exhibit 22-2 ...