Asked by Kevin Simpson on May 14, 2024

Verified

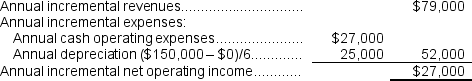

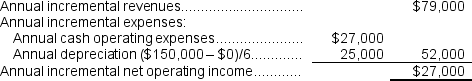

(Ignore income taxes in this problem.)Ducey Corporation is contemplating purchasing equipment that would increase sales revenues by $79,000 per year and cash operating expenses by $27,000 per year.The equipment would cost $150,000 and have a 6 year life with no salvage value.The annual depreciation would be $25,000.

Required:

Determine the simple rate of return on the investment to the nearest tenth of a percent.Show your work!

Operating Expenses

Costs incurred in the regular functioning of a business, excluding direct production costs; these may include rent, utilities, and administrative salaries.

Sales Revenues

Income earned by a company from its sales of goods or services, before any deductions.

Annual Depreciation

The annual expense taken for a fixed asset, representing a fraction of its cost spread over its lifespan.

- Comprehend and ascertain the simple rate of return (accounting rate of return) for different projects.

Verified Answer

DP

divar pointsMay 16, 2024

Final Answer :  Simple rate of return = Annual incremental net operating income ÷ Initial investment

Simple rate of return = Annual incremental net operating income ÷ Initial investment

= $27,000 ÷ $150,000 = 18.0%

Simple rate of return = Annual incremental net operating income ÷ Initial investment

Simple rate of return = Annual incremental net operating income ÷ Initial investment= $27,000 ÷ $150,000 = 18.0%

Learning Objectives

- Comprehend and ascertain the simple rate of return (accounting rate of return) for different projects.